- InGeniusly Speaking

- Posts

- 1 Down, 11 To Go

1 Down, 11 To Go

By Jeff Walton & Kelly Guest

The weather seems to be hitting most of the country on the backside as January makes its way out the door. Party perspectives were on tap at a hearing for HUD Secretary Turner at a hearing last week, that icy chunk of real estate known as Greenland made a lot of news, and interest rates went in a circle. We’re one month in; 2026 looks to be a spirited one already.

Table of Contents

CHATTER

Affordability Ideas from Trade Orgs: NMN

In a letter to National Economic Council Director Kevin Hassett, the MBA, Independent Community Bankers of America and America’s Credit Unions suggested the following:

End requirement to buy 3 credit reports (tri-merge)

Reduce LLPAs

Lower FHA MIP

Turner on the Hill: Partisanship Prevailed (Scotsman Guide)

Republicans praised efforts to streamline the agency, Democrats complained about discontinuance of Biden-era Fair Housing initiatives.

Turner testified that his tenure has focused on fiscal responsibility and organizational efficiency. He referenced the discovery of nearly $5 billion in potential improper payments within the agency in fiscal year 2024, holding this up as a demonstration of HUD’s commitment to these goals.

“To help prevent fraud, waste and abuse, we are taking steps to improve recipient and subrecipient reporting, enhance HUD monitoring capabilities and streamline grants management,” said Turner, adding that the agency is also focused on “rooting out corruption at public housing authorities and private multifamily owners,” citing HUD’s focus on corruption in Atlantic City, N.J., as an example.

Ginnie Got Game

GNMA Touts Strong FY25

Ginnie Mae released its fiscal year 2025 Annual Financial Report, highlighting strong financial performance, sustained market confidence, and continued progress in strengthening the U.S. housing finance system.

For fiscal year 2025, total issuance was $526.4 billion, contributing to a 7.2-percent year-over-year increase in the outstanding portfolio, which grew by $190.9 billion to more than $2.8 trillion as of September 30, 2025.

Another Lawzuit

Zillow Ztrikes Again: Another Mortgage Steering Suit (NMN)

Zillow is facing another antitrust lawsuit, this time from a real estate agent who described the company's efforts to steer homebuyers to its allegedly less competitive mortgage business.

Stephanie Dupuis, an agent with a team based across the Puget Sound from the Seattle real estate listing giant, filed her class action last week in a Washington federal court. The complaint echoes earlier claims from Araba Armstrong, an Alaska homebuyer who accused Zillow of violating the Real Estate Settlement Procedures Act in steering prospective borrowers to Zillow Home Loans.

More Haggling & Name Dropping (NMN)

United Wholesale Mortgage and its chief marketing officer are distancing themselves from the Katie Sweeney legal saga, denying they have undue influence over AIME.

The case now sits in a Michigan federal court, after Sweeney's complaint was elevated to a Texas federal court last spring. The sides have entangled additional mortgage players in the litigation, although only AIME, UWM, Sweeney and DeCiantis are named parties.

Big-time RE Wealth Transfer

Cha-Ching! $2.4T in Real Estate Wealth Will Transfer in Next 10 Years (Coldwell Banker)

Coldwell Banker Global Luxury® program's 2026 Trend Report, which finds that Gen X and Millennials are set to be the two largest cohorts to inherit $4.6 trillion in global real estate wealth over the next 10 years. The United States is expected to capture 52% of that property transfer, funneling a historical share of generational wealth into U.S. real estate.

Since 2020, global wealth among high-net-worth individuals has grown nearly 40%, including a 29.4% increase in real estate holdings, underscoring real estate's role as a long-term wealth anchor.

Millennials Spend Big on Home: Angi’s 2025 State of Home Spending Report

Millennials have become the primary drivers of today’s home projects economy, generating the highest total home spending per household of any generation. While Millennials are not yet the largest group of homeowners, they outspend all other generations on a per-household basis, signaling their growing influence on how Americans invest in their homes.

Their momentum shows no signs of slowing: 77% of surveyed Millennials say they plan to take on a major home project in the next five years, the highest of any generation.

MOVING & SHAKING

Planet Home Lending added Scott Henley as Correspondent Regional Sales Manager.

Gershman Mortgage promoted 4 to Officer roles: Ben Helmerich (NMLS #1991049) and Amber Moser (NMLS #1996946) have been named Vice Presidents. Courtney Jett and Matt Ortinau have been promoted to Assistant Vice President roles.

Fay Group named Michael Hartman as CMO.

MARKET/INDUSTRY

Interest rates finished last week where they started, but there's a lot going on from an upcoming Fed meeting and global events. Check out Bill Bodnar's latest Master the Markets segment.

Mortgage Rates Remain the Lowest in Three Years: Freddie 1-22-26

Mortgage Applications Increased 14.1% from One Week Earlier: MBA Weekly Survey for the week ending 1-16-26.

The Market Composite Index, a measure of mortgage loan application volume, increased 14.1% on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 17% compared with the previous week.

The Refinance Index increased 20% from the previous week and was 183% higher than the same week one year ago.

The seasonally adjusted Purchase Index increased 5% from one week earlier. The unadjusted Purchase Index increased 12% compared with the previous week and was 18 percent higher than the same week one year ago.

“Mortgage rates declined further last week, driving another big week for refinance applications, which saw the strongest level of activity since September 2025.” – Joel Kan, MBA VP & Deputy Chief Economist

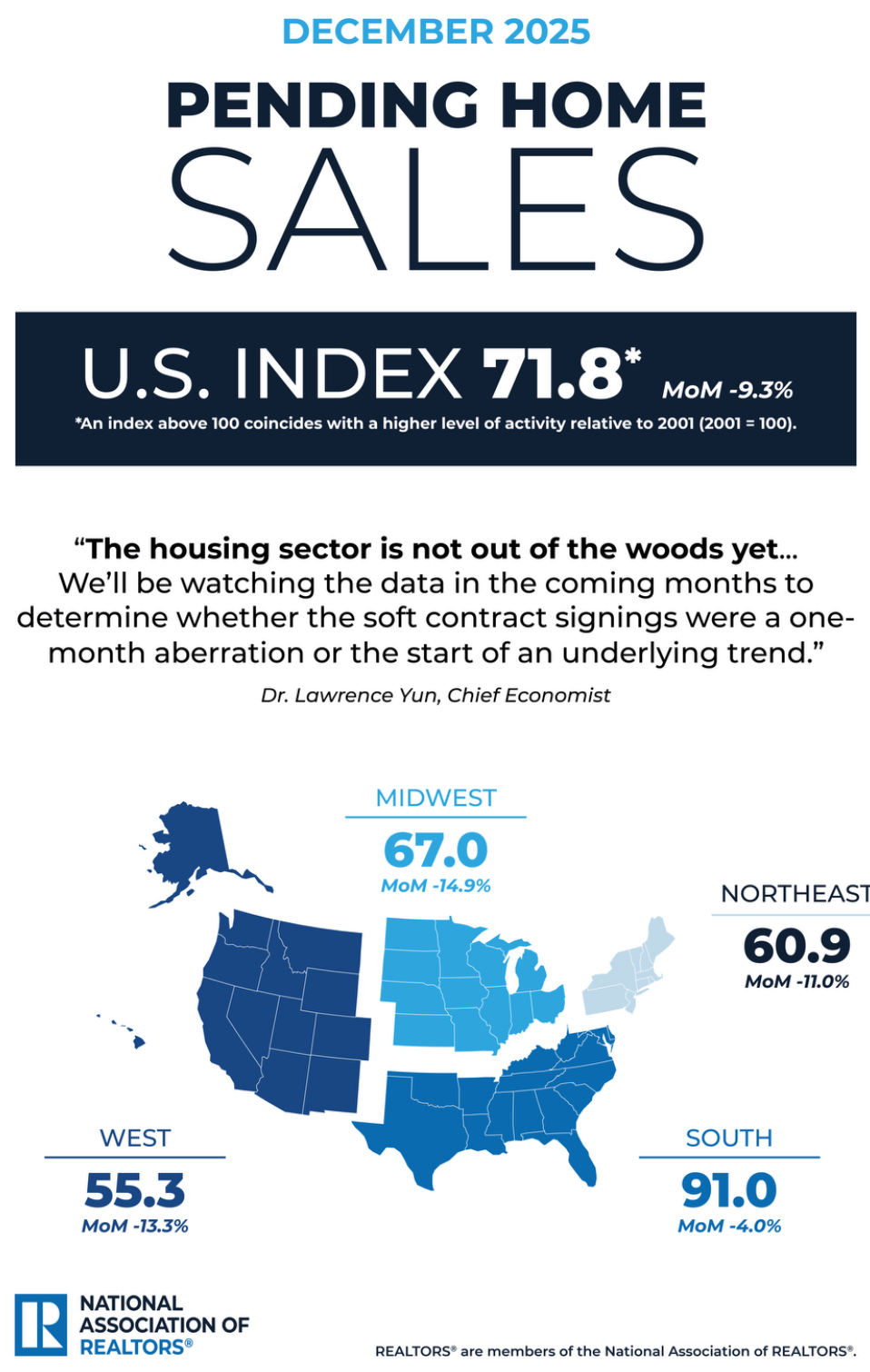

Not Out of the Woods Yet

Pendings Plunge: NAR PHS 12-25

Month Over Month

9.3% decrease in pending home sales

Declines in all four regions

Year Over Year

3.0% decrease in pending home sales

Gains in in the South; declines in the Northeast, Midwest, and West

“Data shows closing activity increased in December. However, new listings did not keep pace so inventory decreased. Consumers prefer seeing abundant inventory before making the major decision of purchasing a home. So, the decline in pending home sales could be a result of dampened consumer enthusiasm about buying a home when there are so few options listed for sale. In December there were only 1.18 million homes on the market – matching the lowest inventory level of 2025.” – NAR Chief Economist Dr. Lawrence Yun

Thank You Captain Obvious: Redfin Says Market Picking Up on Lower Mortgage Rates

U.S. pending home sales fell 2.9% year over year during the four weeks ending January 18, the smallest decline in over a month, as mortgage rates declined.

New listings followed a similar pattern as pending sales: They dipped 1.6% year over year, the smallest decline since November. Mortgage-purchase applications rose 5% week over week to their highest level in three years.

Cost Cutting: Housing Costs Start Year Down 5.5% Redfin

The median U.S. monthly housing payment dipped to $2,413 during the four weeks ending January 11, near the lowest level in two years and down 5.5% from a year earlier. That’s the biggest decline since October 2024.

Monthly housing payments would be falling more if not for still-rising sale prices. The median home-sale price is up 1% year over year, though it’s worth noting that’s small compared to the 4% to 5% increases at the start of 2025.

Where “Buy” is Actually Beating “Rent”

Buy Beats Rent in Majority of Counties: ATTOM Data

The 2026 Rental Affordability Report finds owning a home is more affordable than renting a three-bedroom property in a majority of U.S. counties. In 57.7% of counties analyzed, typical homeownership expenses consumed a smaller share of wages than rent, even as record-high home prices continue to challenge would-be buyers. The top national trend shows home prices rising faster than rents in most markets, reinforcing long-term ownership advantages despite high upfront costs.

Home prices increased faster than rents in 69% of analyzed counties, led by large markets such as Los Angeles, Harris, and Maricopa counties.

Regional divides remain stark, with buying more affordable in 81.5% of Midwestern counties, compared to just 16.9% in the West.

Renting a three-bedroom home required more than one-third of local wages in nearly ¾ of counties, underscoring widespread rental strain.

Wage growth outpaced rent increases in over 76% of counties, and exceeded home price growth in 59%, offering some relief in select markets.