- InGeniusly Speaking

- Posts

- B.(L)S.?

B.(L)S.?

By Jeff Walton & Kelly Guest

"It must be nice to be wrong all the time and still get paid." Some think that old saying about weather forecasters has applied to the Bureau of Labor Statistics - until last Friday. Whether you're miffed about a spate of job numbers revisions or that BLS Commissioner Erika McEntarfer was shown the door, last week was a spectacle. The BLS controversy almost made people forget about the first time in 32 years that two Fed Governors dissented with the Chairman's decision not to cut the Fed funds rate, while a third - Adriana D. Kugler - submitted her resignation effective August 8.

Whatever's going on now, it's up from last year:TheMBAsays that even though mortgage applications were down 3.8% overall last week, the unadjusted purchase index was 17% higher and the refi index was up 30% than the same week one year ago.

CHATTER

VA Home Loan Program Reform Act Becomes Law: H.R. 1815

Creates a partial claim program at VA to give veterans behind in their payments a second chance to keep their homes

Allows veteran borrowers to pay agent commission

What will tariffs aimed at Canada do to home building costs? National Mortgage News takes a look. The administration announced potential 35% tariffs due to Canada's "lack of cooperation" in stemming the flow of fentanyl across their borders.

Circumventing the Settlement? Alternatives to the National Association of Realtors are aggressively reaching out to agents nationwide. One licensed member of the InGeniusly Speaking team received an email from MyStateMLS that said, "…it's time to decide whether or not you're going to proceed as a member of the current NAR system even though they have made your job more difficult through the Settlement terms."

Loan File Errors Costs Consumers $7.8B: Software Firm LoanLogics

The due diligence, audit, and automation solution company compiled internal data showing 11.5% of all U.S. mortgage loan file content was missing or erroneous over the last 10 years.

The company estimates that inefficient systems, loan file errors, and resulting delays throughout the mortgage loan process translate to higher costs to consumers.

Flyhomes gets $15M in Series D funding to pivot from direct-to-consumer platform to wholesale financial products provider. The company is focusing on the buy-before-you-sell model.

Boards of Rocket and Mr. Cooper approved the acquisition. (HW)

AnnieMac Home Mortgage expands into the sunshine state with acquisition of certain assets of Florida Funding. (NMN)

After dodging legal bullets in its fight with Move Inc., Homes.com parent CoStar is suing Zillow for copyright infringement for publishing over 45,000 copyrighted listing photos without permission.

Dem Senators Push Back on Pulte: Letter Hints at Conflicts of Interest

5 Senators on the committee for banking, housing and urban affairs sent a letter to the FHFA Director after he issued a directive to pave the way for the GSEs to accept crypto currency as an asset when obtaining a mortgage.

The Senators took shots at Trump, crypto execs and Pulte, accusing the director of stacking the GSEs’ boards with industry allies and questioning the legality of his appointment.

MOVING & SHAKING

Compass CFO Kalani Reelitz Announced Departure.

Nexa Mortgage appointed Jason duPont as COO.

Embrace Home Loans promoted Brian Woltman to SVP.

NMP reports that Verus Mortgage Capital hired Tony Santangelo as wholesale regional manager.

MONEY

Freddie Mac's net income dropped $378M (14%) YoY:

The GSE reported net income of $2.4 billion, and EVP & CFO Jim Whitlinger said, "This decrease was primarily driven by higher provision for credit losses in both of our business segments."

Fannie Mae's net income was down $1.2B YoY in Q2: Also reduced quarterly administrative expenses 15% from Q1, 6% YoY.

Rocket Closes on Redfin; Company Says They…

Generated Q2'25 total revenue, net of $1.36 billion and adjusted revenue of $1.34 billion. Adjusted revenue came in above the high end of our guidance range

Reported Q2'25 GAAP net income of $34 million and adjusted net income of $75 million

Intercontinental Exchange (ICE) shows profit in Q225: "For the quarter ended June 30, 2025, consolidated net income attributable to ICE was $851 million on $2.5 billion of consolidated revenues, less transaction-based expenses."

Compass says they "…delivered the best quarterly results in our history, marked by ten all-time highs," and that "Revenue in Q2 2025 increased by 21.1% year-over-year to $2.06 billion as transactions increased 20.9% compared to the market transactions, which declined by 0.9%."

Additionally, HousingWire reports on Compass CEO Robert Reffkin's latest shots at the National Association of Realtors after saucy attacks on Zillow and Northwest MLS.

Rithm/Newrez posts pre-tax income of $275M for Q225: Newrez generated a 19% pre-tax return on equity (“ROE”) on $5.8 billion of equity.

MARKET/INDUSTRY

The narrative changed dramatically: In his latest Master the Markets segment, Bill Bodnar revisits the wild week with Fed activity, notes the governors will be out speaking in earnest this week, and previews what to watch.

Mortgage Rates Inch Down: Freddie 7-31-25

MBA’s Fratantoni on the Fed:

“Unfortunately for the housing and mortgage markets, the Fed’s actions with respect to short-term rates are likely to have little impact on longer-term rates, including mortgage rates. MBA’s forecast is for 30-year fixed mortgage rates to move just a little lower to perhaps 6.5% over the next year, as longer-term rates continue to be impacted by large deficits and debt and the growing issuance of Treasury securities to fund those deficits, which will likely keep mortgage rates near today’s level even as the Fed loosens monetary policy.” - MBA Chief Economist Mike Fratantoni

Mortgage Applications Decreased 3.8% From One Week Earlier, Affordability Increases: MBA Weekly Survey for the week ending 7-25-25. Homebuyer affordability improved in June, with the national median payment applied for by purchase applicants decreasing to $2,172 from $2,211 in May. (MBA’s PAPI)

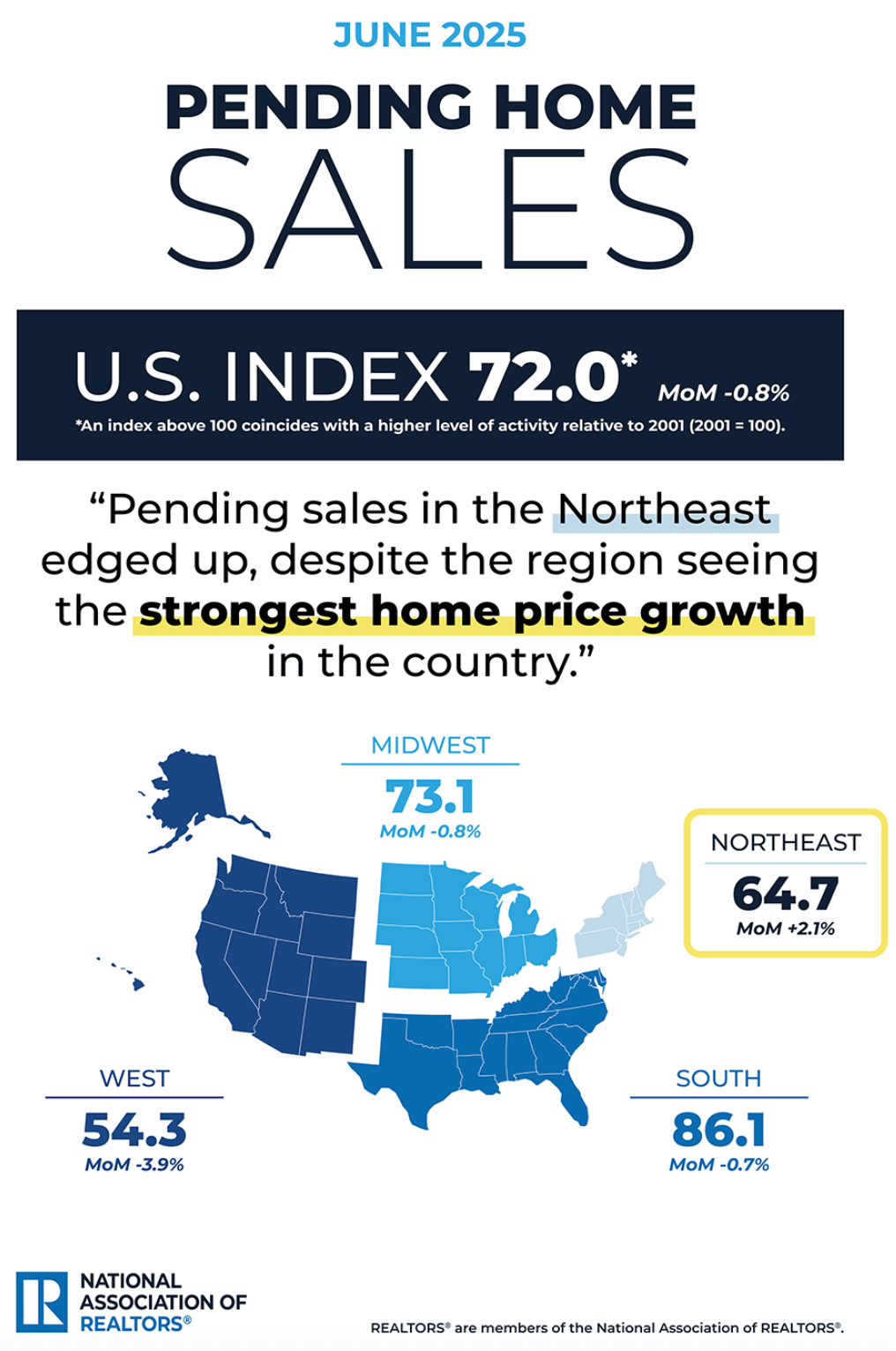

Sluggish with Signs of Life: NAR June PHS

Month-Over-Month: 0.8% decrease in pending home sales: Declines in Midwest, South, and West; gains in Northeast

Year-Over-Year: 2.8% decrease in pending home sales: Declines in Midwest, South, and West; unchanged in Northeast

NAR Chief Econ Lawrence Yun’s Takes: "The data shows a continuation of small declines in contract signings despite inventory in the market increasing. Pending sales in the Northeast increased incrementally even though home price growth in the region has been the strongest in the country.”

"The REALTORS® Confidence Index shows early indications of potential contract signings increasing moving forward. REALTORS® are optimistic that homebuying and selling activity will increase. That confidence is supported by the fact that mortgage applications have been rising."

Home Price Growth Will Slow: Freddie Forecast

The GSE's modeled, observed house prices declined 0.6% in Q2.

Their current house price forecast assumes an increase of 1.3% over the next 12 months and 0.4% over the subsequent 12 months.

This is a change from their forecast at the end of Q1, which assumed 4.2% growth over the next 12 months and 2.8% growth over the subsequent 12 months.

Values Prop Up Equity: Q225 Home Equity & Underwater Report ATTOM Data

Record-high property values are behind the rebound in number of equity-rich properties: 47.4% of mortgaged homes are now equity-rich, up from 46.2% in Q1, reversing a three-quarter decline. Meanwhile, 2.7% of mortgaged properties remain seriously underwater, down slightly from the previous quarter but still higher than a year ago.

Equity-rich homes rose in 37 states and D.C., with the biggest annual gains in Connecticut, New Jersey, Alaska, West Virginia, and Wyoming.

The largest equity declines occurred in Florida, Arizona, Georgia, Colorado, and Washington.

Vermont leads in equity-rich shares, while Louisiana continues to struggle, holding both the lowest equity-rich rate and the highest share of seriously underwater homes.

Commercial/Multi-Family Originations Increase 66% in Q225: MBA

Compared to a year earlier, a rise in originations for office, health care, and industrial properties led to an overall increase in commercial/multifamily lending volumes.

There was a 140% YoY increase in the dollar volume of loans for office properties, a 77% increase for health care properties, a 53% increase for industrial properties, and a 30% increase for retail properties.

Originations for multifamily properties decreased 35%, and hotel property loan originations decreased 30% compared Q224.