- InGeniusly Speaking

- Posts

- Bazookapalooza?

Bazookapalooza?

By Jeff Walton & Kelly Guest

Table of Contents

Last week brought some good indicators for the industry as the new year gets underway: Lowest mortgage interest rates in 3 years, strong existing home sales in December, a slew of policy ideas aimed at increasing affordability and boosting homeownership prospects for more American consumers. Greenland is in the news like a frozen ping pong ball, so it'll be interesting to see if or how a "trade bazooka" aimed at the US from the EU will affect the spring market.

CHATTER

Don’t Grab My Gains!

Texas Rep Intros Don't Tax the American Dream Act

Congressman Craig Goldman’s bill would…

Eliminate all federal capital gains taxes on primary residence sales after the homeowner has lived in the property for two years

Increase the national housing supply

Repeal costly taxes on American homeowners

Restore the American Dream of homeownership by improving housing affordability

Background: Currently, tax filers can exempt up to $250,000 (individual) or $500,000 (married filing jointly) from capital gains taxes when selling a primary residence after living in it for at least two years. However, these exemption caps have remained unchanged since 1997, despite significant increases in home values.

Newrez to Recognize Crypto in Mortgage Origination

Targeted to launch in February, the new offeringwill allow crypto assets to be used without liquidation in the mortgage approval process, preserving greater investment autonomy for digital asset holders.

Student Loan Shuffle

Proactive Pre-Approval? PRMG + LoanSense Partner to Help Student Debt Holders

Paramount Residential Mortgage partnered with LoanSense to help pull through more borrowers in the lender's current pipeline.

PRMG will be able to identify potential borrowers with student loan debt early in the loan origination process. “Our Loan Officers will receive notifications where borrowers can lower their student loan payments and overall debt burden, all within the mortgage process,” said Chris Sorensen, SVP/Director National Retail Production at PRMG.

LoanSense’s core technology and advising services are designed to identify the clients that can save money through federal and private student loan programs. Lenders can know within 24 hours of application if LoanSense can improve home affordability.

MOVING & SHAKING

Post-Rocket Reorg? HW: Redfin CEO Glenn Kelman is stepping down after over 20 years leading the company.

MBA added Jeremy Green as VP of Legislative Affairs.

Planet Financial Group Launches its Own Insurance Agency - NMP

NEXA Lending appointed Todd Bitter as National Director of Sales.

Logan Finance named Chuck Vaughn Managing Director of Correspondent Lending.

The Conference of State Bank Supervisors named Chad Davis SVP of Legislative Policy.

Justin Demola joined Equifax as SVP, Mortgage & Housing.

MARKET/INDUSTRY

Bill Bodnar brings a little Fed history to this week's Master the Markets segment. The rest of the news might not be quiet, but the Fed will be this week. Tune in and find out what else the industry needs to watch.

The Average 30-Year FRM Hits Lowest Level in Over 3 Years: Freddie 1-15-26

Mortgage Applications Increased 28.5% from One Week Earlier: MBA Survey for the week ending 1-9-26. Last week’s results included an adjustment for the New Year’s Day holiday.

The Market Composite Index increased 28.5% on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 65% compared with the previous week.

The Refinance Index increased 40% from the previous week and was 128% higher than the same week one year ago.

The seasonally adjusted Purchase Index increased 16% from one week earlier. The unadjusted Purchase Index increased 51% compared with the previous week and was 13% higher than the same week one year ago.

The MBA Builder Application Survey (BAS) data for December 2025 shows mortgage applications for new home purchases increased 2.5% YoY. Compared to November 2025, applications decreased by 3%.

Beige Isn’t Necessarily Boring…

Meh to Improving: Federal Reserve Beige Book 1-14-26

Overall economic activity increased at a slight to modest pace in eight of the twelve Federal Reserve Districts, with three Districts reporting no change and one reporting a modest decline. This marks an improvement over the last three report cycles where a majority of Districts reported little change.

Residential real estate sales, construction, and lending activity softened in the majority of Districts that report on the sector.

Several Districts also noted that spending was stronger among higher-income consumers with increased spending on luxury goods, travel, tourism, and experiential activities. Meanwhile, low to moderate income consumers were seen to be increasingly price sensitive and hesitant to spend on nonessential goods and services.

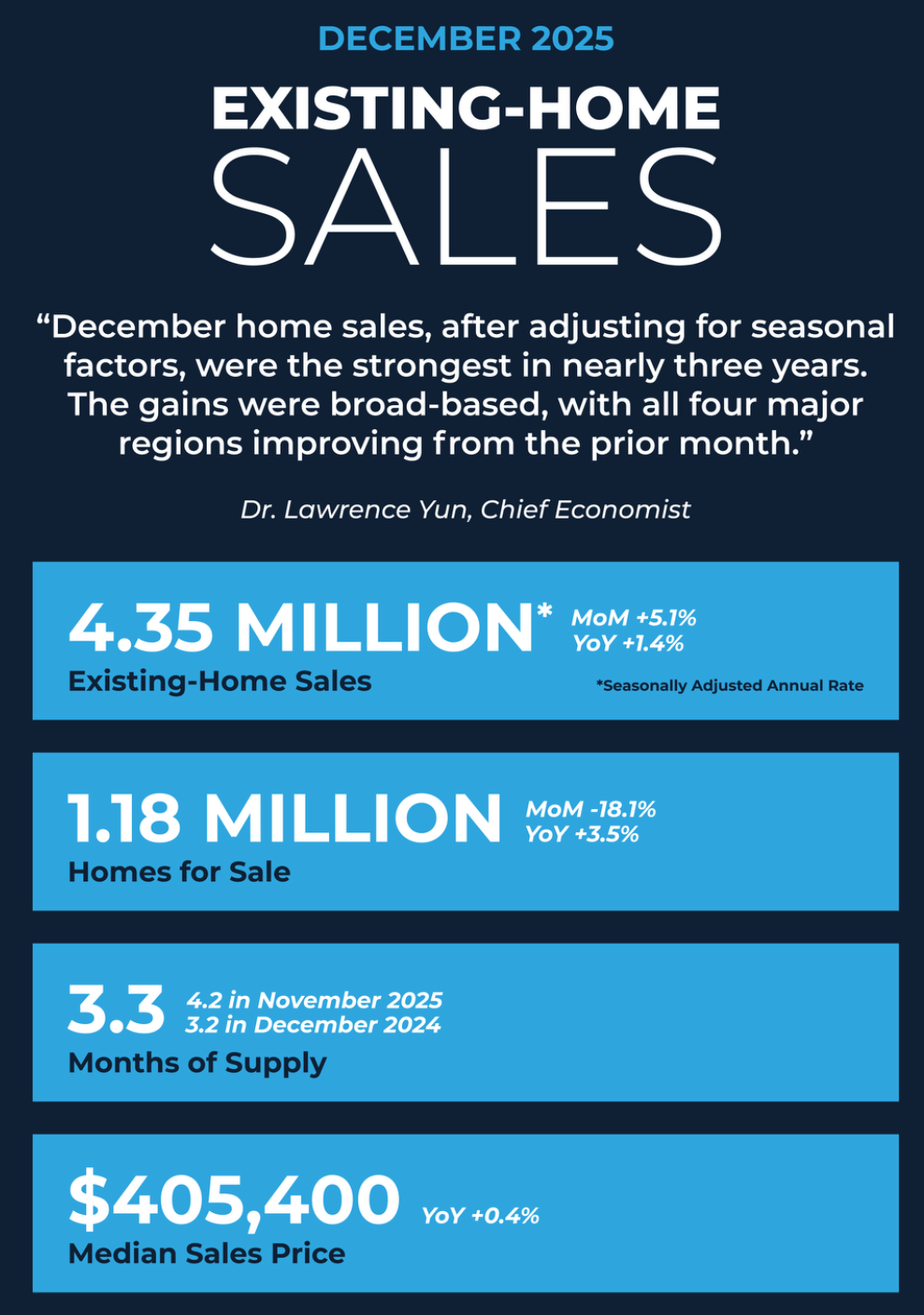

Holiday Rush: NAR EHS 12-25

Month Over Month:

5.1% increase in existing-home sales – seasonally adjusted annual rate of 4.35 million in December

18.1% decrease in unsold inventory – 1.18 million units equal to 3.3 months' supply

Year Over Year:

1.4% increase in existing-home sales

0.4% increase in median existing-home sales price to $405,400

"2025 was another tough year for homebuyers, marked by record-high home prices and historically low home sales. However, in the fourth quarter, conditions began improving, with lower mortgage rates and slower home price growth. December home sales, after adjusting for seasonal factors, were the strongest in nearly three years. The gains were broad-based, with all four major regions improving from the prior month." - NAR Chief Economist Lawrence Yun.

Affordability Challenge: Q425 Affordability Report

Median-priced single family homes and condos were less affordable than historical averages in nearly every county with sufficient data available for analysis.

The report also indicated that in 99% (586 of 594) of the counties analyzed by ATTOM, median-priced single-family homes and condos were less affordable than historical averages in the final quarter of the year. This pattern also held in the prior two quarters, as the national median home price remained near a record high of $365,000.

What’s Up with Non-QM?

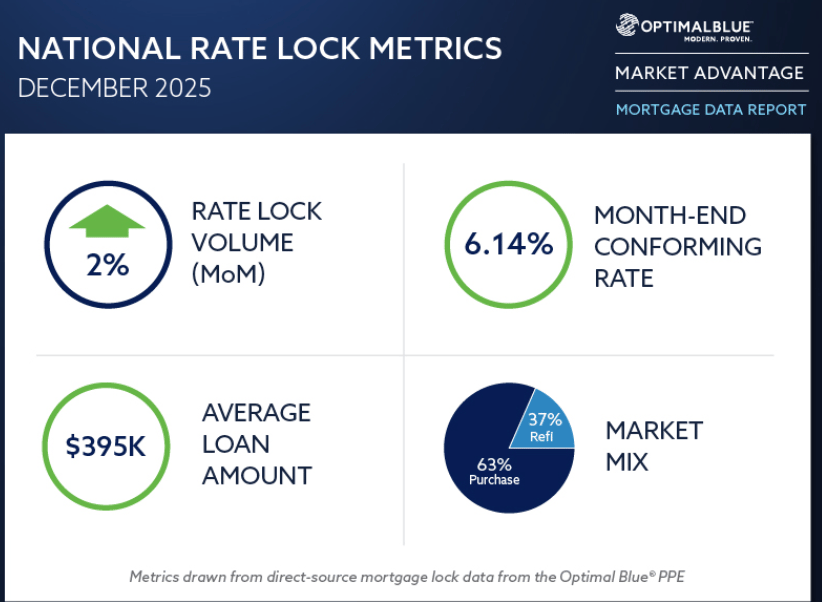

Locks Finish Solid: Optimal Blue December Rate Lock Metrics

Non-QM sets another record: Non-qualified mortgage production maintained its upward trajectory, finishing December above 9% of locks, up 50 bps MoM.

Government and non-conforming gain share: Conforming loans accounted for 51% of locks in December, down 86 bps MoM and 18 bps YoY. Non-conforming share rose to 17%, up 17 bps MoM and 141 bps YoY. FHA, VA and USDA loans each gained share during the month.

Investors Hold a Solid 1/3

Investor Activity: Batch Data

Investors accounted for over 34% of all home purchases in Q3 2025, representing the highest percentage in at least seven quarters despite a 6% decrease in absolute purchase volume.

Large institutional investors (1,000+ properties) continue as net sellers for the seventh consecutive quarter, selling 5,798 homes while purchasing only 4,663 in Q3 2025.

Investors holding 1-10 properties own 96% of all investment properties in the US, controlling over 14.6 million homes across the country.

Investor purchase prices averaged $449,981 and sales prices averaged $412,517 in Q3—both well below the $512,800 national average home price.

Five states account for one-third of all investor-owned properties: Texas (1.4M), California (1.2M), Florida (1M), North Carolina (788K), and Georgia (600K).

Filings Up, Still Not Too Bad: 2025 Year End Foreclosure Report - ATTOM Data

Foreclosure filings were up 14% year-over-year, but still 25% below 2019 levels and 87% below the 2010 peak.

Foreclosure starts increased 14 percent from 2024, though volumes remain well below pre-pandemic benchmarks.

Bank repossessions rose 27% year-over-year, yet REO activity is still down nearly 70% compared to 2019.

Average time to foreclose continued to shorten, with properties foreclosed in Q4 2025 taking 592 days on average, down 22% from a year earlier.