- InGeniusly Speaking

- Posts

- Cautious Optimism & Anemic Increases

Cautious Optimism & Anemic Increases

By Jeff Walton & Kelly Guest

Table of Contents

CHATTER

Highlights from the Biggest Industry Event of Year

MBA announced it expects origination volume to increase 8% YoY to increase to $2.2T in 2026 from $2.0T expected in 2025.

Purchase originations are forecast to increase 7.7% to $1.46T next year and refinance originations are expected to increase 9.2% to $737B.

By loan count, total mortgage origination volume is expected to increase 7.6% to 5.8M loans in 2026 from 5.4M loans expected in 2025.

Marina Walsh, CMB, Vice President of Industry Analysis noted during her presentation that production profitability in the second quarter of 2025 was the highest since 2021, a welcome development after ten quarters of net production losses over that same time period.

NOTE: MBA’s predictions are below this story from last week: iEmergent Predicts 13% YoY Increase in Originations for 2026

Gimme Shelter!

A tad backward-looking, but: Bill Bodnar says the CPI numbers had some great nuggets for the mortgage industry in his latest Master the Markets segment. Will the Fed finally end quantitative tightening? We’ll know soon.

FHFA Director Pulte Orders Task Force to Review LLPAs: Barry Habib to Lead the Charge

Pulte’s X post announcing the move says in part, “[ ]… working hard to present me options to fix LLPAs (a/k/a PRICING!!!!) and bring some relief to HOMEOWNERS AND HOME BUYERS [ ].”

Audacious Ohio: State Legislature Introduces Bills to Limit Prop Taxes to Inflation Rates (HW)

The Ohio House passed two bills limiting future property tax increases by tying them to inflation. House Bill 186 caps outside millage growth at the inflation rate, while House Bill 335 allows counties to replace property tax revenue with local income taxes. The measures could save Ohio taxpayers an estimated $2.4 billion.

Homeowners Staying Longer: ATTOM Data

Homeowners who sold in Q325 had owned their homes for an average of 8.39 years, the longest tenure in at least 25 years and up from 8.13 years in the previous quarter. State-by-state homeowner tenures are available at the above link.

Home Builders Profits Up in Spite of Falling Sales: NMN

Publicly traded homebuilders were tested in the most recent quarter by slowing volume and political and economic factors, but proved resilient as they navigated through various challenges.

Companies reported shrinking profits but still posted positive numbers, with falling mortgage rates providing some boost, even as consumer sentiment languishes.

Companies now face additional pressure potentially coming from the federal level to address affordability as their industry enters what is their slow season.

MOVING & SHAKING

Fannie Mae moved COO Peter Akwaboah to acting CEO and promoted John Roscoe and Brandon Hamara Co-Presidents.

Christine Chandler EVP, COO, M&T Realty Capital Corporation (RCC), was sworn in as 2026 Chair of the Mortgage Bankers Association (MBA) during the association’s 2025 annual convention.

APM CEO to Retire: NMP

Chairman, President & CEO Bill Lowman announced he will retire and APM named Dustin Sheppard as his replacement.

NEXA Lending hired Tammy Richards as Chief Strategy Officer.

Long Time Coming: Home BancShares Announces 1st M&A Deal in 3 Yrs. (NMN)

Home BancShares in Conway, Arkansas, has signed a letter of intent for its first bank deal in more than three years.

"I believe in fixing your existing problems before you make a new move. That's exactly what Home has been doing for the past three years," Chairman and CEO John Allison said.

Home's third-quarter return on assets of 2.17% is nearly double the industry-wide average, according to FDIC statistics.

LenderMAC and Ares enter into Non-QM Partnership.

MARKET/INDUSTRY

It’s the Low Point of 2025…

Mortgage Rates Decrease to Lowest Level in Over a Year: Freddie 10-23-25

What Saw an 81% YoY Increase?

Mortgage Applications Decreased 0.3% From One Week Earlier: MBA Weekly Survey for the week ending 10-17-25.

Big Note: The Refinance Index increased 4% from the previous week and was 81% higher than the same week one year ago.

“The lowest mortgage rates in a month spurred an increase in refinance activity, including another pickup in ARM applications. The 30-year fixed rate decreased to 6.37% and all other loan types also decreased,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist.

Finally Fannie: FNMA ESR Group Revises Forecast

We forecast mortgage rates to end 2025 and 2026 at 6.3% and 5.9%, respectively, compared to 6.4 and 5.9% in our prior forecast.

We have revised our real gross domestic product (GDP) growth outlook for 2025 and 2026 to 1.9% and 2.3 % on a Q4/Q4 basis, respectively, compared to 1.5 % and 2.1 % in our prior forecast.

We forecast the Consumer Price Index (CPI) to be 2.9 % Q4/Q4 in 2025, down from our September projection of 3.1 %. The outlook for 2026 is 2.7 % (up from 2.6 % previously). Core CPI is expected to be 3.1 % Q4/Q4 in 2025 (down from 3.2 % previously) and 2.6 % in 2026 (down from 2.7 % previously).

Our total home sales outlook for 2025 was revised to 4.74 M, up from 4.72 M previously. Our 2026 home sales projection is 5.16 M, unchanged from prior forecast.

In our quarterly update to our house price forecast, we now expect home price growth to be 2.5 % and 1.3 % in 2025 and 2026 on a Q4/Q4 basis, respectively, compared to 2.8 % and 1.1 % in our prior forecast.

We project single-family mortgage originations to total $1.88 T and $2.35 T, respectively, for 2025 and 2026, compared to our previous forecast of $1.85 T and $2.32 T, respectively.

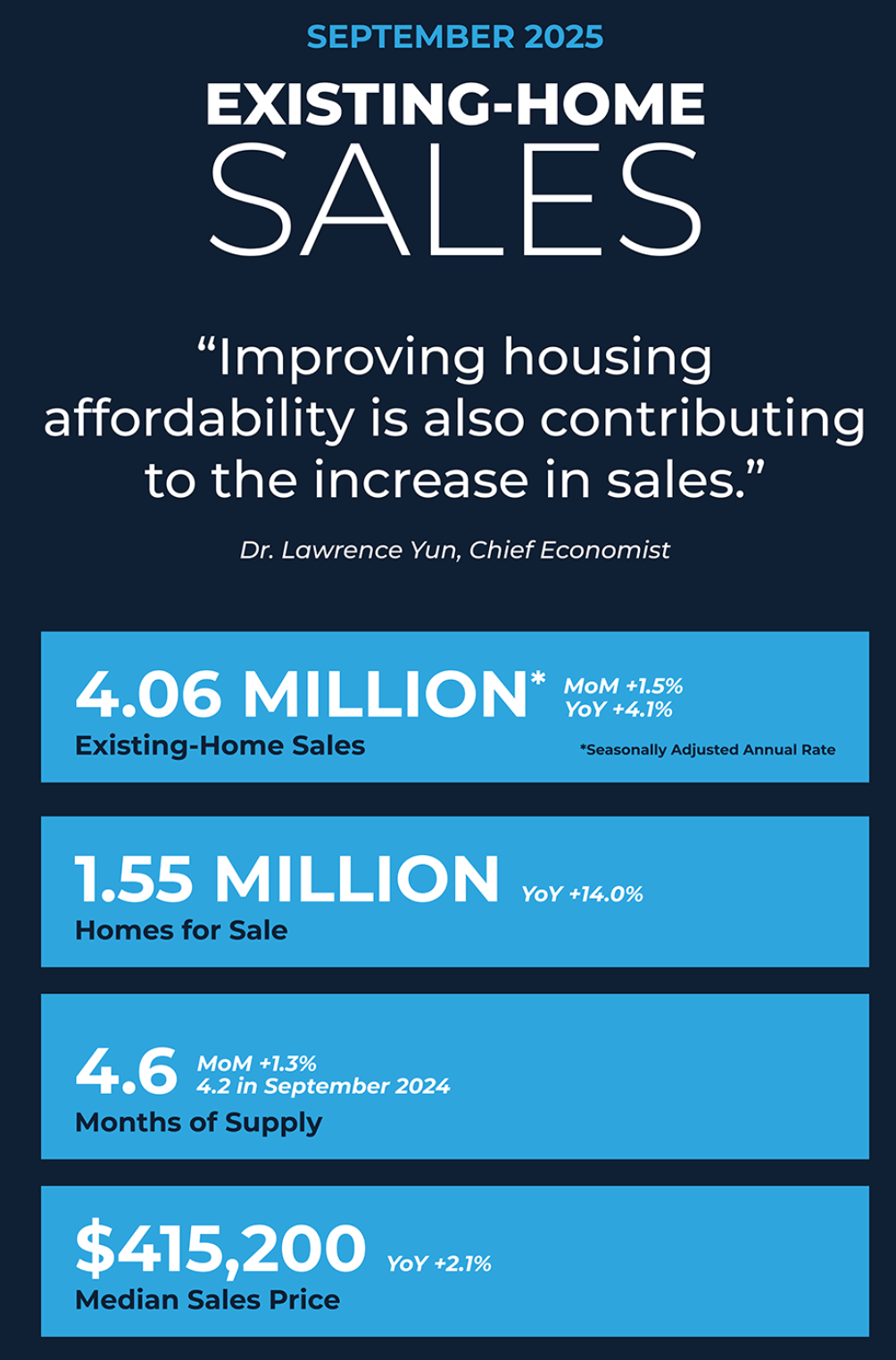

It’s Something: 1.5% YoY Increase (NAR September Existing Home Sales)

Month-over-month:

1.5% increase in existing-home sales – seasonally adjusted annual rate of 4.06 M in September

1.3% increase in unsold inventory – 1.55 M units equal to 4.6 months' supply

Year-over-year:

4.1% increase in existing-home sales

2.1% increase in median existing-home sales price to $415,200

"As anticipated, falling mortgage rates are lifting home sales. Improving housing affordability is also contributing to the increase in sales. Inventory is matching a five-year high, though it remains below pre-COVID levels. Many homeowners are financially comfortable, resulting in very few distressed properties and forced sales. Home prices continue to rise in most parts of the country, further contributing to overall household wealth." - NAR Chief Economist Dr. Lawrence Yun

Equity Decline: ATTOM Data’s Q325 Home Equity & Underwater Report

Homeowner equity declined slightly, with 46.1% of mortgaged homes considered equity-rich, down from 47.4% last quarter and 48.3% a year ago.

Meanwhile, 2.8% of properties were seriously underwater, marking a small but steady uptick from last year, even as national median home prices reached a record $370,000.

State-level shifts: The share of equity-rich homes rose in 19 states quarter-over-quarter, led by New York, New Jersey, and Connecticut, while Florida, Arizona, and Colorado posted the largest declines.

Underwater homes increase broadly: Seriously underwater rates rose in 35 states quarter-over-quarter and 46 states year-over-year, with the steepest jumps in D.C., Maryland, and Louisiana.

Regional highlights: The Midwest continued to dominate with the highest equity-rich counties, while Louisiana led the nation with the largest share of seriously underwater properties.

Quality and Affordability on the Upswing

Affordability Increases to Best in 2.5 Years: ICE Mortgage Monitor 10-25

With 30-year mortgage rates averaging 6.26% in mid-September, the monthly principal and interest (P&I) payment on an average-priced home has fallen to $2,148, or 30% of the median U.S. household income. Though still more than five percentage points above its long-run average, P&I costs have declined from 32% earlier this summer and significantly improved from their 35% peak in late 2023.

Home prices firm as affordability improves and inventory tightens: Annual home price growth rose to +1.2% in September after eight months of slowing, driven by falling inventory and improved affordability. Nationally, listings remain 17–19% below 2017–2019 norms, as sellers in previously oversupplied markets delay sales to avoid price cuts.

Borrower profiles reflect improved financial stability: The average credit score for purchase locks has climbed above 736, the highest recorded in the six-year history of ICE’s origination dataset, indicating a shift toward a more credit-qualified borrower mix. At the same time, debt-to-income (DTI) ratios for purchase rate locks have dropped to 38.5%, marking their lowest level in 2.5 years as affordability continues to improve. For rate-and-term refinances, the average DTI has fallen to 34.1%, a 3.5-year low, while the average credit score has risen to 722, a nine-month high.

Overall foreclosure volume remained historically low, with foreclosure sales reaching 21,000 in the third quarter this year, roughly half of 2019's pre-pandemic levels.

Number of All-Cash Sales Still on Decline: Redfin

Just under three in 10 (28.8%) U.S. homebuyers paid in all cash in August, down just incrementally from 29% a year earlier.

The prevalence of all-cash payments peaked at nearly 35% in late 2023 and early 2024 because mortgage rates peaked in the high-7% range during that time. Buyers were inclined to pay in cash— if they could afford it—to avoid high monthly interest payments.

While the share of buyers paying cash has declined from its high point, it is essentially unchanged from last year.

“First-time buyers have more opportunities than they did when the market was hot; they’re no longer competing against 10 other offers from people who are either paying in cash or shelling out a 50% down payment,” said Kathy Scott, a Redfin Premier agent in Phoenix.