- InGeniusly Speaking

- Posts

- Feisty Fed

Feisty Fed

By Jeff Walton & Kelly Guest

Table of Contents

CHATTER

Cantankerous Chorus?

3 Fed Govs Speak Out Against December Rate Cut

Dallas Fed Pres Lorie Logan and Cleveland Pres Beth Hammack say they may oppose another rate cut this year after Kansas City Pres Jeff Schmid dissented to the recent cut. Fed Chair Jerome Powell told reporters that a December cut is not a foregone conclusion amidst a “growing chorus” who thinks they should pause.

Differing Dissents

Mortgage Bankers Association’s Mike Fratantoni on the Fed:

"The FOMC met expectations with a 25-basis-point cut at its October meeting. The statement indicated that the Committee was more concerned about downside risks to the job market, although the last official data point was from August, hinting other data points showing further softening. Of note, there were two dissents to this rate cut decision, with Governor Miran preferring a 50-bps cut and Kansas City Fed president Schmid opting for no change in rates. MBA is forecasting another two 25-basis-point cuts to the federal funds target in December 2025 and then in the first quarter of 2026.

“The FOMC also announced that it would be ending quantitative tightening on December 1st, indicating that the overall balance sheet will no longer be shrinking. MBS prepayments and amortization will be rolled into Treasuries going forward.

“As these moves were anticipated by the market, MBA does not expect any significant changes to mortgage rates as a result. Mortgage rates are currently around their low for the year and this has spurred both refinance and purchase activity.

“So…what would you say you do here?”

The Pulte Purge: FHFA Director Cuts 62 Positions at FNMA

Pulte’s X account said, “Today Fannie Mae executed a standard business layoff of over 62 people, across the COO, Information Technology, "DEI", and other divisions. We, like any business, must eliminate positions that are not core, or otherwise, to mortgages and new home sales. We have 7,000+ employees!”

Pulte also posted this: “Recently, I asked a Fannie Mae manager about dozens of employees at Fannie Mae and what they did during the day. The manager could not even tell me what his employees did. He then agreed to eliminate the positions. Wild!”

Optimal Blue Calls B.S. (HW)

Optimal Blue CEO Joe Tyrrell spoke to HousingWire about ta class action lawsuit filed against it and 26 mortgage lenders, calling the claims “baseless” and “frivolous” and vowing to fight the lawsuit “all the way through.”

The suit accuses Optimal Blue and the lenders of violating federal antitrust laws, alleging that the defendants “exploited their control of the residential mortgage industry to orchestrate a price-fixing scheme that has inflicted substantial damages on Plaintiffs and the Class.”

Sweeney is now claiming that AIME sponsor United Wholesale Mortgage (UWM) interfered with her transition agreement and wants UWM and a member of its C-suite as defendants in the suit. Both sides accuse the other of wrongdoing.

Taking Aim at NAR: HW Reports on Group of Brokerage Leaders Pushing for Change

The “Pro-Agent Restore Trust in NAR Working Group” has identified issues including the potential legal exposure caused by the Clear Cooperation Policy in its current form, the legal risks imposed by the 3-way Realtor membership agreement, the need for more transparency surrounding NAR’s restructuring plan, an increased need for independent governance, what they perceive as NAR’s “bloated” balance sheet, which they feel makes it a potential target for lawsuits, and for the disclosure of NAR’s financial interests in Second Century Ventures.

Minnesota Makes a Move; Will a trend ensue?

Minnesota MLSs Cut Bloat: HW

The major MLSs in MN (MAR, SPAAR, and SEMR) agreed to cut governance board from 20 to 11. 5 BOD members will be active RE pros, 6 will be chosen from OUTSIDE the industry, called “independent directors,” and are expected to bring subject matter expertise in law, tech, and marketing.

Hard Core Calling? TCPA Suit vs. Swift Home Loans

The complaint accuses Swift of contacting people on the national Do Not Call registry among other things.

Rocket Shoots to Top Spot: American Customer Satisfaction Index

Mortgage lenders continue to occupy the lower end of the Index overall for customer satisfaction with an ACSI score of 74, dipping 1% from 2024 and placing them ahead of just three other ACSI industries.

Rocket Mortgage claims the top spot among mortgage lenders for a second year, soaring 4% to 83 to land 9 points above the industry average. Bank of America also enjoys an impressive jump of 3%, now claiming the number two spot at 79.

The ACSI performance gap widens, with a 15-point difference between leader Rocket Mortgage and the lowest-rated lender in the study, Freedom Mortgage (68).

Among lender types, credit unions (78) lead in customer satisfaction, scoring 4 points higher than banks and 6 points above independent mortgage lenders, with standout performance in service-related metrics along with fees and costs.

Q325 EARNINGS

Q3 revenue was up 16% year over year to $676 million, above the company's outlook range.

Residential revenue was up 7% year over year in Q3 to $435 million, benefiting from growth across the company's agent and software offerings and within the company's New Construction marketplace.

Mortgages revenue increased 36% year over year to $53 million in Q3, primarily due to a 57% increase in purchase loan origination volume to $1.3 billion.

Net income of $2.8 billion for the third quarter of 2025, down 11% from the third quarter of 2024, primarily driven by a credit reserve build in the current period compared to a credit reserve release in the prior year period.

Net revenues of $5.7 billion for the third quarter of 2025, a decrease of 2% year-over-year, primarily driven by lower non-interest income, partially offset by higher net interest income.

Generated Q3'25 total revenue, net of $1.61 billion and adjusted revenue of $1.78 billion. Adjusted revenue came in above the high end of our guidance range

Reported Q3'25 GAAP net loss of $124 million and adjusted net income of $158 million

Newrez parent company Rithm Capital

Newrez posted pre-tax income of $295.1 million in Q3’25, excluding the net of hedge mortgage servicing rights (“MSRs”) mark-to-market loss of $(61.0) million, up from $275.1 million in Q2’25, excluding the net of hedge MSRs mark-to-market gain of $29.9 million.

MOVING & SHAKING

Rate announced that Chris Planto has returned to the company as VP of Mortgage Lending.

Fannie Mae announced the promotion of two long-time Fannie Mae veterans: Jake Williamson to Acting Head of Single-Family and Tom Klein to Acting General Counsel.

MGIC Investment Corporation elected Martin Klein and Daniela O'Leary-Gill to its board and that of its principal subsidiary, MGIC.

Jet Direct Mortgage welcomes back 203(k) specialist Andy Thaw as VP of Renovation Lending.

American Financial Resources (AFR) has rebranded as eLend - to "deliver a modern, tech-driven mortgage experience for brokers and borrowers alike."

FICO Partners with Xactus to Offer Credit Simulator on Subsidiary Platform: “We’re excited to offer the FICO Score Mortgage Simulator on SharperLending’s credit platform because it is set to become an essential tool for mortgage professionals,” said Michael Crockett, chief operating officer at Xactus.

Xactus Partners with Plaid: The collaboration will bring Plaid’s FCRA-compliant Verification of Assets (VOA) solution, to Xactus360, expanding the platform’s intelligent verification capabilities for mortgage lenders.

PartnerOne Enters Agreement to Acquire Mortgage Cadence.

MARKET/INDUSTRY

Mortgage Rates Continue to Trend Down: Freddie 10-30-25

Mortgage rates decreased for the fourth consecutive week. The last few months have brought lower rates and homebuyers are increasingly entering the market.

Mortgage Applications Increased 7.1% from One Week Earlier: MBA Weekly Survey for the week ending 10-24-25.

The Market Composite Index increased 7.1% on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 7% compared with the previous week.

The Refinance Index increased 9% from the previous week and was 111% higher than the same week one year ago.

The seasonally adjusted Purchase Index increased 5% from one week earlier. The unadjusted Purchase Index increased 4% compared with the previous week and was 20% higher than the same week one year ago.

Homebuyer affordability improved in September, with the national median payment applied for by purchase applicants decreasing to $2,067 from $2,100 in September. -MBA’s Purchase Applications Payment Index PAPI

Stuck at Same

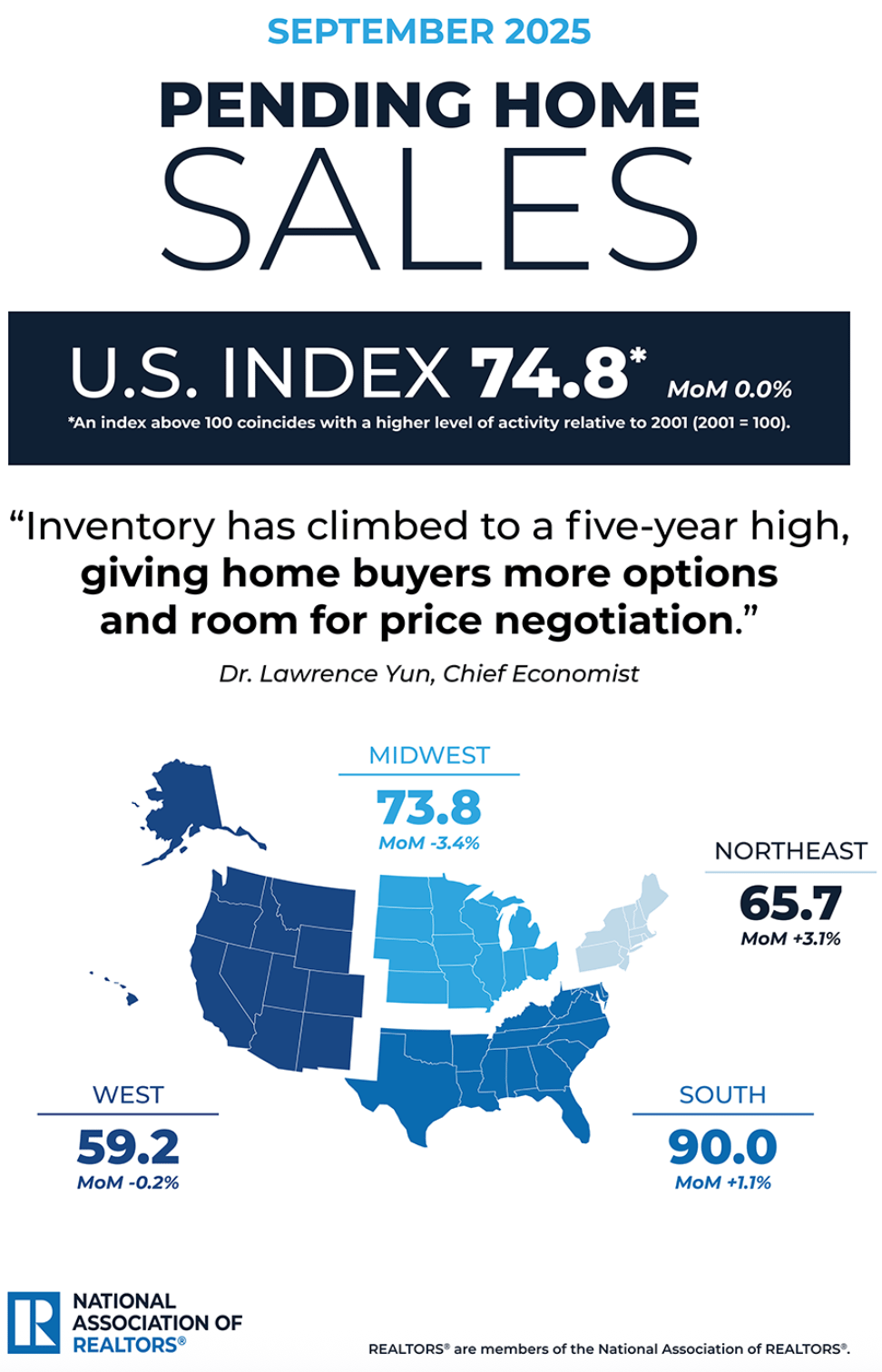

NAR Pending Home Sales 9-25

Month Over Month:

No change in pending home sales; gains in the Northeast and South; declines in the Midwest and West.

Year Over Year:

0.9% decrease in pending home sales; gains in the Northeast and South; declines in the Midwest and West.

"Contract signings matched the second-strongest pace of the year. However, signings have yet to fully reach the level needed for a healthy market despite mortgage rates reaching a one-year low," said NAR Chief Economist Lawrence Yun.

People are Planted: Point2Homes Analysis Says We’re Moving Way Less

Mobility is steadily falling: In the 1900s, nearly one in three Americans moved each year. Then, by the 1960s, it was one in five. In 2024, only about one in nine people changed residences.

A historic low: Last year, only 11% of the entire population relocated nationwide as Americans move less and less.

Few make big moves: Of those who did move, only 19.3% changed states in 2024, compared to 20.1% the year before.