- InGeniusly Speaking

- Posts

- 1 Month to Go

1 Month to Go

By Jeff Walton & Kelly Guest

Table of Contents

Ah, December 1. This week leaves the tryptophan coma behind to go full frontal jingle bell. The housing market slogs along, but Santa came a little early for IMBs. Enjoy the quiet period, because scrutiny over Congressional insider trading seems to have bled over to the Fed. All eyes are on smiley Kevin Hassett to see if he succeeds the embittered – er, um, embattled – Mr. Powell.

CHATTER

Shame on You for Finding Out…

CA Rep Swallwell Sues FHFA Director Bill Pulte Over Mortgage Fraud Cases

The lawsuit alleges that Federal Housing Finance Agency Director Bill Pulte “abused his position” to “concoct fanciful allegations of mortgage fraud.”

Swalwell, who recently launched a run for governor of California, says the referral relies on a “gross mischaracterization,” pointing to sworn documents showing his D.C. home was not his primary residence.

The filing argues that Pulte has referred only Trump critics including New York Attorney General Letitia James, Sen. Adam Schiff, D-Calif., and Federal Reserve Governor Lisa Cook.

Move Over Oligarchy – We’ve Got an Oligopoly

Credit Reporting Increases No Bueno: MBA Blasts Price Increases

“Once again, the national credit bureaus are abusing their government-granted oligopoly by gouging consumers – a predictable outcome in a flawed, outdated, and anticompetitive system where lenders are required to buy specific, increasingly-expensive credit reporting data from each of the three credit bureaus. MBA has long led the call to fix this broken model and shined a light on the role that regulations and the government play in these steep, unjustified price hikes that ultimately hurt housing affordability.”

“We are continuing to push for more transparency and fairness in this process. Today’s news only strengthens our call to move away from the tri-merge credit report structure. Single-file reports are used safely in nearly every other consumer finance market, and extending them into the mortgage market would provide price relief for American homebuyers by injecting real competition, lowering closing costs, and streamlining the mortgage process, all without compromising sound risk management.” - MBA's President and CEO Bob Broeksmit, CMB

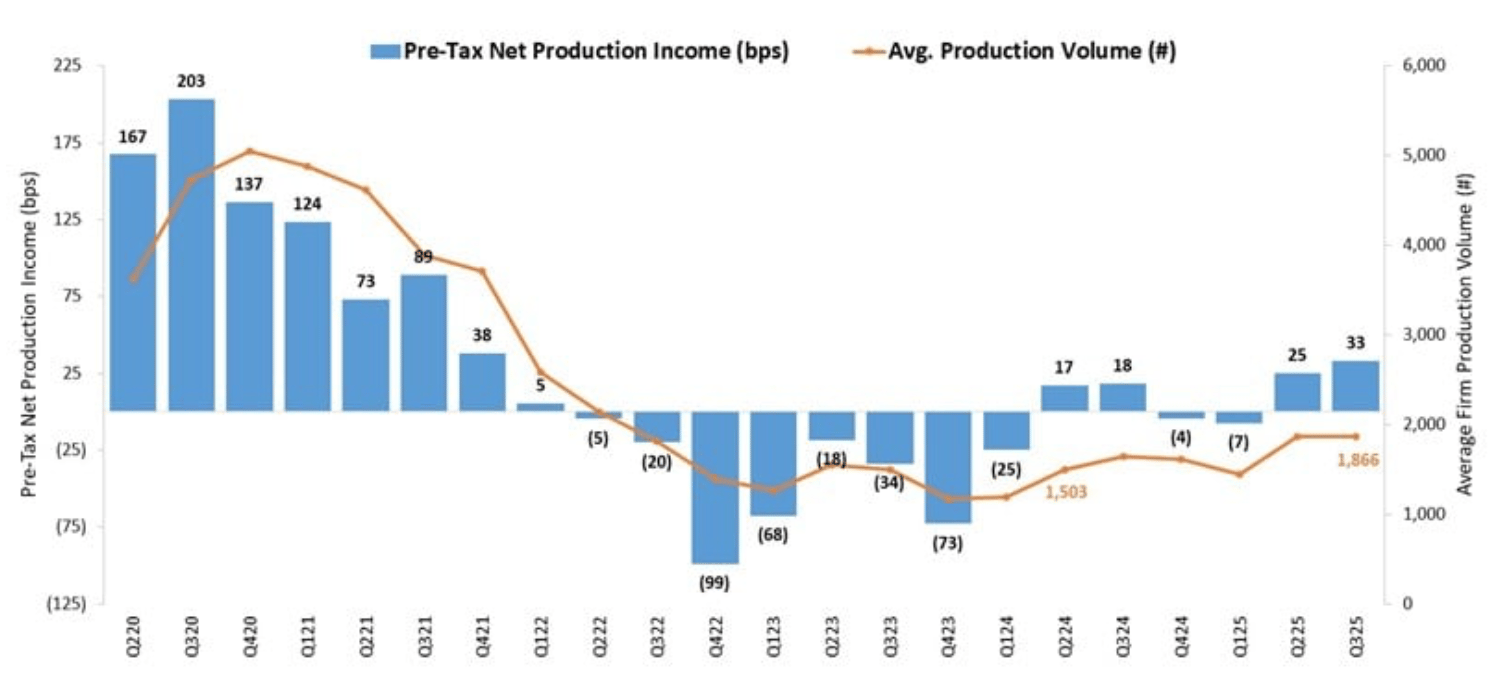

Not since Q421…

IMB Profits Up Again: MBA Q3 Performance Report

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net production profit of $1,201 on each loan they originated in the third quarter of 2025, compared to a net production profit of $950 per loan in the second quarter of 2025

85% of the over 325 companies in MBA’s sample posted overall profits

“While Q3 closed loan volume was relatively flat, and per-loan production expenses rose slightly compared to the second quarter, the increase in recorded production revenue drove profits higher in the third quarter.” - - Marina Walsh, CMB, MBA’s Vice President of Industry Analysis.

The average pre-tax production profit was 33 basis points (bps) in Q325, compared to profit of 25 bps in Q225. The average quarterly pre-tax production profit, from the first quarter of 2008 to the most recent quarter, is 40 basis points.

The average production volume was $634M per company in the third quarter, down slightly from $636M per company in the second quarter. The volume by count per company averaged 1,866 loans in the third quarter, up from 1,862 loans in the second quarter.

Total production revenue (fee income, net secondary marketing income, and warehouse spread) increased to 359 bps in the third quarter, up from 346 bps in the second quarter. On a per-loan basis, production revenues increased to $12,310 per loan in the third quarter, up from $11,914 per loan in the second quarter.

Total loan production expenses – commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations – increased to 326 basis points in the third quarter of 2025 from 321 basis points in the second quarter of 2025. Per-loan costs increased to $11,109 per loan in the third quarter, up from $10,965 per loan in the second quarter of 2025. From the first quarter of 2008 to last quarter, loan production expenses have averaged $7,799 per loan.

The purchase share of first mortgage originations, by dollar volume, was 82%. For the mortgage industry as a whole, MBA estimates the purchase share was at 67% in the third quarter of 2025.

Nothing that $95B won’t fix…

“A committee is a cul-de-sac down which ideas are lured and then quietly strangled.” Sir Barnett Cocks, in New Scientist – 1973.

Saying Trump admin has made housing crisis worse, Center for American Progress pushes $95B initiative – and a new bureaucracy: CAP recommends a new federal initiative—called Advanced Research Projects Agency-Home (ARPA-Home)—to fund, incubate, and scale innovations that can dramatically expand housing production, cost-reducing energy efficiency and resiliency, and affordability.

NMN Explores Fed Ethics Issues – Compares to Public Disgust with Congressional Insider Trading

Key Insight: Even though ethics violations among Fed officials are uncommon, high-profile cases like that of former Fed Gov. Adriana Kugler highlights persistent questions about oversight effectiveness.

Expert Quote: "When you're in a position that's as influential as working at the Federal Reserve, you're governed by the law of Caesar's wife — be above suspicion." — Alex Pollock, senior fellow at the Mises Institute.

What's at stake: The Federal Reserve unveiled new reporting requirements in 2022 for members of the FOMC. The recent Kugler controversy has raised questions about whether the rules are actually working.

MOVING & SHAKING

Bayview Closes on Guild; Takes Company Private

Guild Holdings has been acquired by Bayview MSR Opportunity Master Fund, L.P. in an all-cash transaction valued at approximately $1.3B.

The acquisition aims to bolster Guild's national presence and enhance its mortgage ecosystem.

Following the acquisition, GHLD's publicly traded common stock has been delisted from the NYSE.

LERETA welcomed Kristy Fercho to its board of directors. The provider of real estate tax and flood services for mortgage servicers added Fercho who currently serves as SEVP, Head of Financial Inclusion and Opportunity at Wells Fargo.

MARKET/INDUSTRY

Core PCE release is coming up – but it’s serious rear view mirror stuff. We’re entering the Fed blackout period; but Bill Bodnar has some great nuggets for the industry in his latest Master the Markets segment.

Mortgage Rates Decrease: Freddie 11-26-25

Heading into the Thanksgiving holiday, mortgage rates decreased. With pending home sales at the highest level since last November, homebuyer activity continues to show resilience nearing year end.

Mortgage Applications Increased 0.2% from One Week Earlier: MBA Weekly Survey for the week ending 11-21-25.

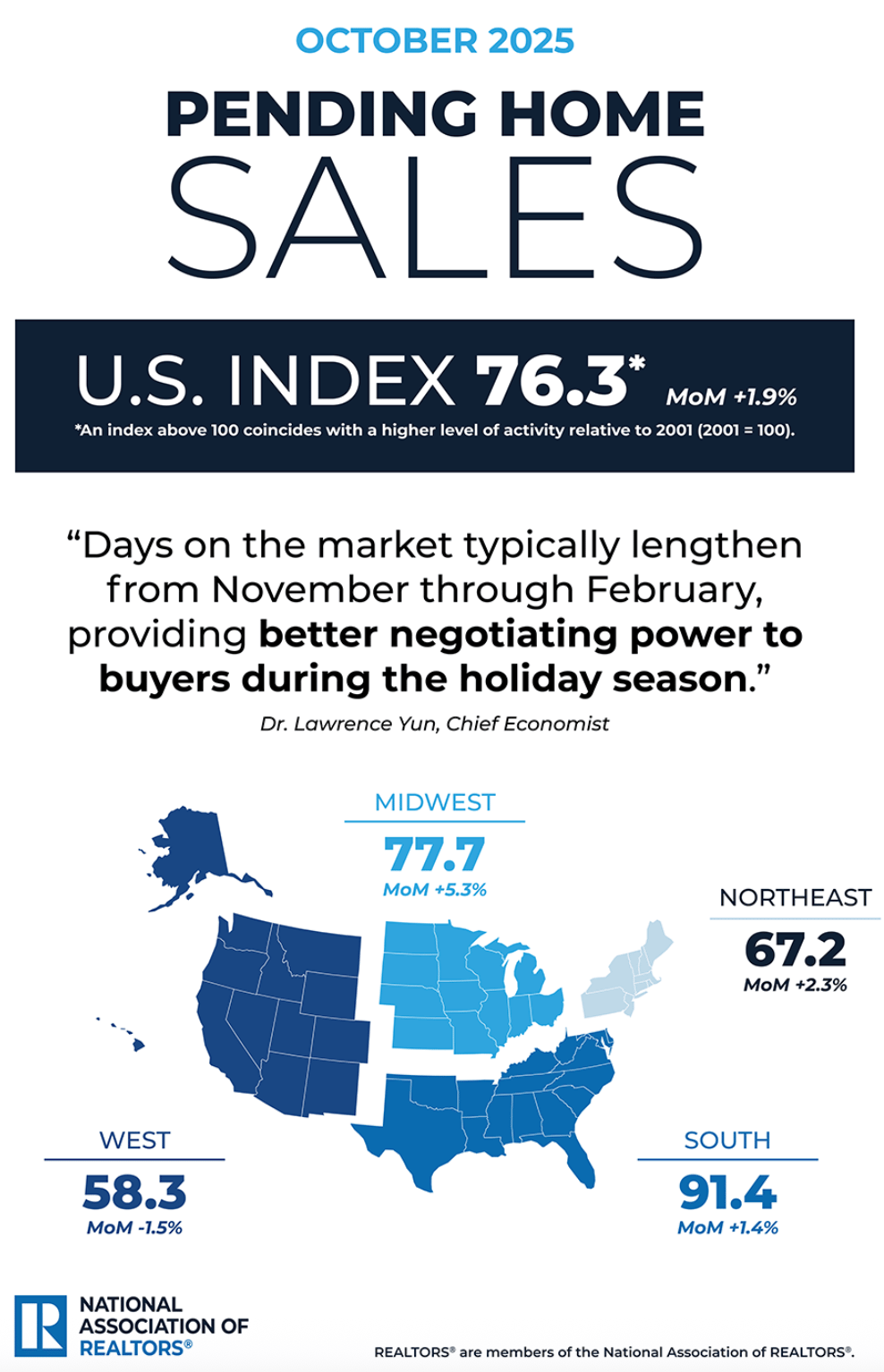

Paltry Pendings

NAR Pending Sales – Oct 2025

Month Over Month:

1.9% increase in pending home sales

Gains in the Northeast, Midwest and South; decline in the West

Year Over Year:

0.4% decrease in pending home sales

Gains in the Midwest and South; decline in the Northeast and West

"Job gains in September, following the data blackout, are reassuring and suggest the economy is not slipping into a recession. This may boost confidence in future homebuying. "Days on the market typically lengthen from November through February, providing better negotiating power to buyers during the holiday season." - NAR Chief Economist Lawrence Yun.