- InGeniusly Speaking

- Posts

- What now?

What now?

By Jeff Walton & Kelly Guest

September 30, 2024

After the Fed's favorite gauge met expectations and we got a 50bps rate cut, the question is, what does the rest of the year look like for originations and real estate sales? NAR's August Pending Home Sales showed an anemic .6% MoM increase and sales were still down YoY; but it's a slight indicator that the mortgage rate easing that was already underway nudged buyers a bit. And speaking of buyers, they still expect sellers to pay 100% of their agents' commission, according to The Real Brokerage's August Agent Survey. The new practice changes took effect 8-17, and two weeks isn't much time for the practice changes to sink in for buyers or the sellers they expect to pay for their agents' services.

Rocky Mountain Real Estate Drama: Allegations of monopoly, antitrust, and anticompetitive practices aren't just happening on the national stage. HW's Jeff Andrews explains the sale of Denver-area MLS REColorado, potential conflicts, and agent opposition.

HousingWire has the latest in the battle of the parent companies, Move vs. Costar: A judge denied a preliminary injunction for the Realtor.com parent company against rival Homes.com's hodling corp. The attorney for Costar took a victory lap and a swipe, saying, "As we have said from the beginning, this case — which Move has tried to weaponize in the press — is a PR stunt in response to the fact that Move is failing in the marketplace." Me-ow.

CHATTER

WIN FOR UWM: FL Judge Dismisses Okavage’s Class Action Suit

A federal judge dismissed the 2021 antitrust case stemming from UWM’s “All In” initiative. “All In” pressured brokers to stop doing business with competitors Rocket and Fairway and to use UWM exclusively.

Newrez owner Rithm Capital is offering 34.5M shares of common stock. HW reports on the details. Meanwhile, Newrez-acquired servicer Specialized Loan Servicing (SLS) is in court over $7.50 "pay to pay" fee: NMN's reporting says the suit alleges that SLS's fee for this action "materially exceeded the costs incurred by SLS (for borrowers to pay by phone)…generating millions of dollars in unlawful profits for SLS."

BAD BREAKUP: Planes, Suits & Automobiles

The 12th Circuit Court in Illinois dismissed the complaint by Smart Mortgage Centers that two former employees “stole” confidential client information from its database in coordination with their new employer, NEXA Mortgage. But, NMP reports that NEXA co-founders Mike Kortas and Matthew Grella are still sparring – even after an AZ judge granted Grella’s motion to dismiss a lawsuit alleging he traded in or sold company cars and kept the proceeds. Grella first filed a lawsuit accusing Kortas of making unauthorized aircraft-related purchases with company funds, which Kortas denied and countersued with the claims about company cars.

CONSUMERS ARE DOING EVERYTHING BUT MORTGAGE: VantageScore August Credit Gauge

New credit account growth increased month-over-month across all products except mortgage.

Overall loan balances rose to the highest level in more than four years. Average loan balances rose by $1,811 YoY in August.

Average credit card balance rose to $6,358, the highest year-to-date; credit card utilization also rose MoM; the increase in Credit Card balances further underscored Americans’ reliance on credit for expenses.

MATERIALITY MORTALITY? 57 U.S. Banks in Precarious Climate Position

“The 11th National Risk Assessment: Portfolio Pressures,” from First Street found that 57 US banks with a total of $627 billion in real estate loans (10.9% of all loans in the country) could face material financial risk. The report also finds a disproportionate financial vulnerability of regional and community banks given the concentrated nature of their lending portfolios which, in the most extreme case, represent a net loss totaling 14% of all real estate loans from an environmental event with a 1% annual likelihood.

ON THAT NOTE: ZILLOW partners with First Street to provide users with data on a property’s risk levels for flood, wildfire, wind, heat and air quality through risk scores, interactive maps and insights into insurance requirements.

AI TAKES THE STAGE AT MBA ANNUAL: Directors from NVIDIA and Amazon will talk innovation. If you're going to MBA Annual in Denver, get a reservation for the Mile High Reception!

INTROS & INNOVATIONS

Simplist coins a term: Company launches what they're calling "the first-ever mortgage experience platform." Sonar "seamlessly integrates loan origination system (LOS) and point-of-sale (POS) systems, providing mortgage professionals with a comprehensive, all-in-one solution to revolutionize the mortgage journey from start to finish."

ICE announced enhancements to help servicers meet 30-day reporting obligations under the Fair Credit Reporting Act. Their enhanced Credit Bureau Management system now allows servicers to automatically send completed forms to third-party credit bureau reporting agencies without requiring manual re-entry of the data.

MARKET/INDUSTRY

THE 30-YEAR FIXED-RATE MORTGAGE REACHES LOWEST LEVEL IN TWO YEARS: Freddie 9-26-24

Although this week’s decline was slight, the 30-year fixed-rate mortgage trended down to its lowest level in two years. Given the downward trajectory of rates, refinance activity continues to pick up, creating opportunities for many homeowners to trim their monthly mortgage payment. Meanwhile, many looking to purchase a home are playing the waiting game to see if rates decrease further as additional economic data is released over the next several weeks. Bill Bodnar ponders the effect of next week’s jobs data on the Fed's next moves and the bond market in his latest Master the Markets segment.

MORTGAGE APPLICATIONS INCREASED 11% FROM ONE WEEK EARLIER: MBA Weekly Applications Survey for the week ending 9-20-24.

The Market Composite Index increased 11% on a seasonally adjusted basis from one week earlier. The number is unchanged on an unadjusted basis.

The Refinance Index increased 20% from the previous week and was 175% higher than the same week one year ago.

The seasonally adjusted Purchase Index increased 1% from one week earlier. The unadjusted Purchase Index increased 0.4% compared with the previous week and was 2% higher than the same week one year ago.

Payments Improved: MBA’s PAPI says homebuyer affordability improved in August, with the national median payment applied for by purchase applicants decreasing to $2,057 from $2,140 in July.

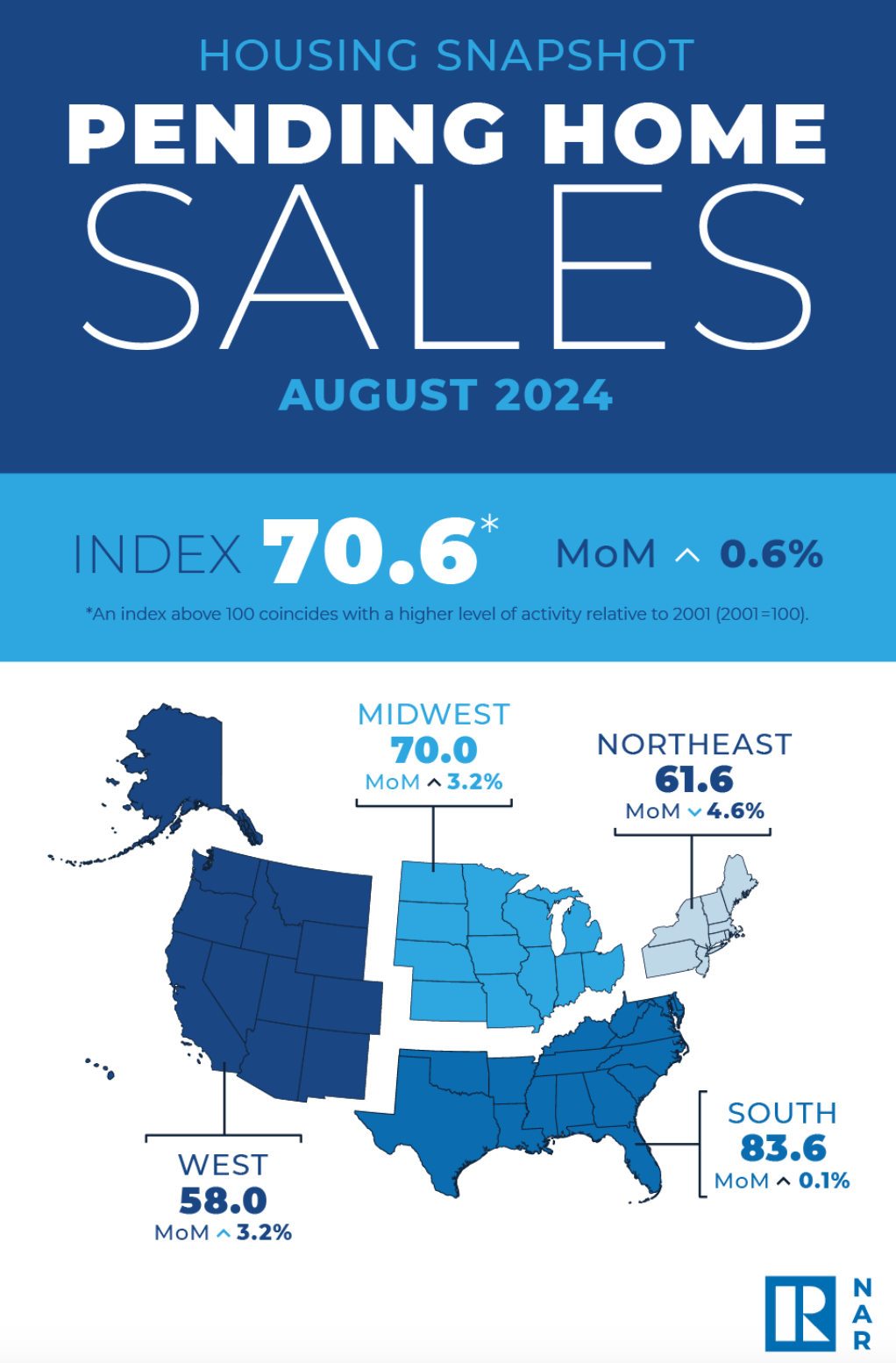

TEENY UPTICK: August Home Sales Up .6% (NAR)

Pending home sales ascended 0.6% in August.

Month over month, contract signings rose in the Midwest, South and West but dropped in the Northeast.

Compared to one year ago, pending home sales decreased in the Northeast, Midwest and South but increased in the West.

AGENT ATTITUDES: The Real Brokerage August ’24 Survey

With a whole 14 days of new practice changes in effect, agents reported their experiences thus far. The survey said…

89% said they were very well - or at least somewhat - prepared for the NAR rule changes

63% of agents said sellers are willing to pay buyer agent commissions, 21% indicated sellers would consider contributing

65% of agents said it was somewhat or very easy to secure buyer representation agreements, while 16% reported challenges

55% of agents reported sellers offering buy-side commissions of 2.5% or greater

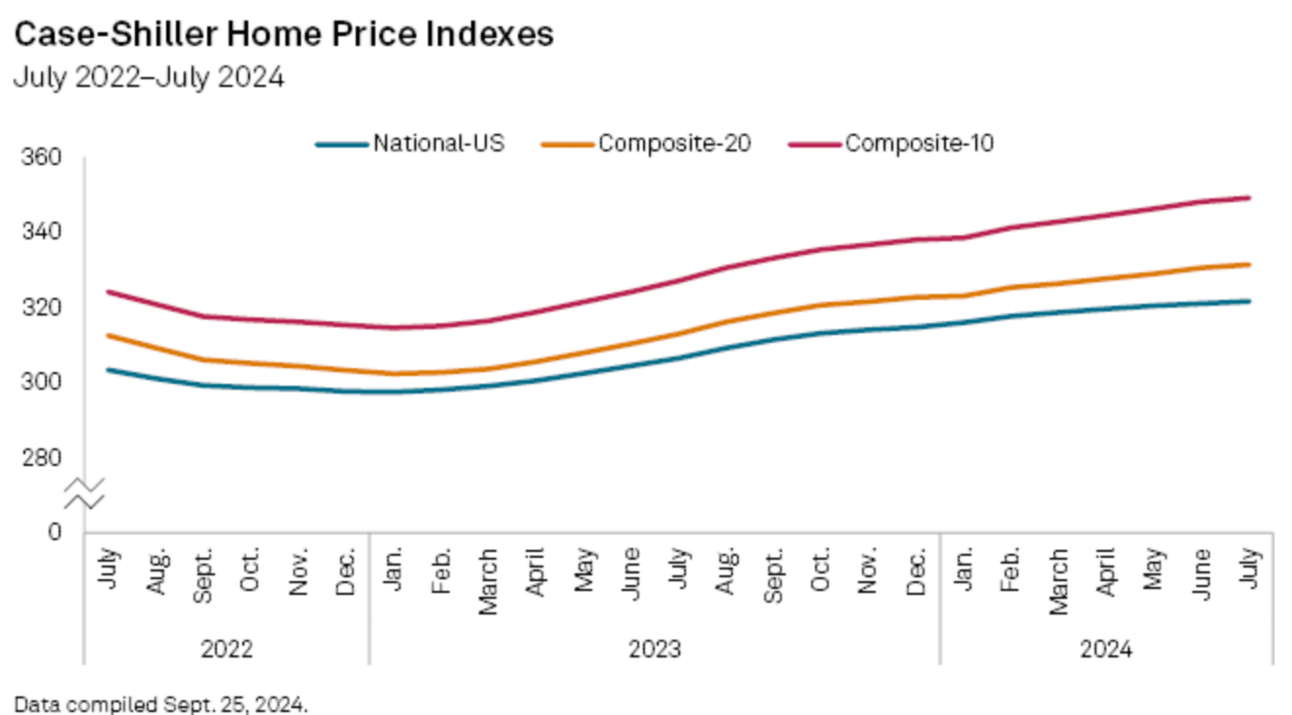

HIGH & SLOW: S&P CoreLogic Case-Shiller July Home Price Indices

US home prices rose to yet another record high in July, although the overall pace of price appreciation slowed.

The National Home Price Index, covering all nine US census divisions, increased 5.0% year over year in July compared with an annual gain of 5.5% in the previous month.

The 10-City Composite grew 6.8% year over year, down from a 7.4% annual increase the month prior.

"Accounting for seasonality of home purchases, we have witnessed 14 consecutive record highs in our National Index. The growth has come at a cost, with all but two markets decelerating last month, eight markets seeing monthly declines, and the slowest annual growth nationally in 2024." - Brian Luke, head of commodities, real and digital assets at S&P Dow Jones Indices 9-24-24

ATTOM AGREES: Slower Price Gains, But Affordability is Arduous

The national median price for single-family homes and condos rose in Q324. The latest figure represents a 1.4% increase over Q224 and is 6.6% above the typical price in Q323, although the pace of increase has slowed compared. (Typical values shot up 7% from the first to the second quarter of this year).

ATTOM’s Q324 U.S. Home Affordability Report: Median-priced single-family homes and condos remain less affordable in Q324 compared to historical averages in 99% of counties around the nation with sufficient data to analyze.

The latest trend continues a pattern, dating back to early 2022, of home ownership requiring historically large portions of wages as U.S. home prices keep reaching new highs.

NOT HUGE, BUT SOMETHING: Redfin Says Income Needed to Afford Median Home Drops 1%

Buyers need to earn $115,000 to afford the typical U.S. home, down 1% year over year.

U.S. homebuyers need to earn an annual income of $115,454 to afford the median priced home ($433,101). That’s down 1.4% year over year—the first annual decline since June 2020.

Still, the typical household only earns $84,000—27% less than it needs to afford the typical home.

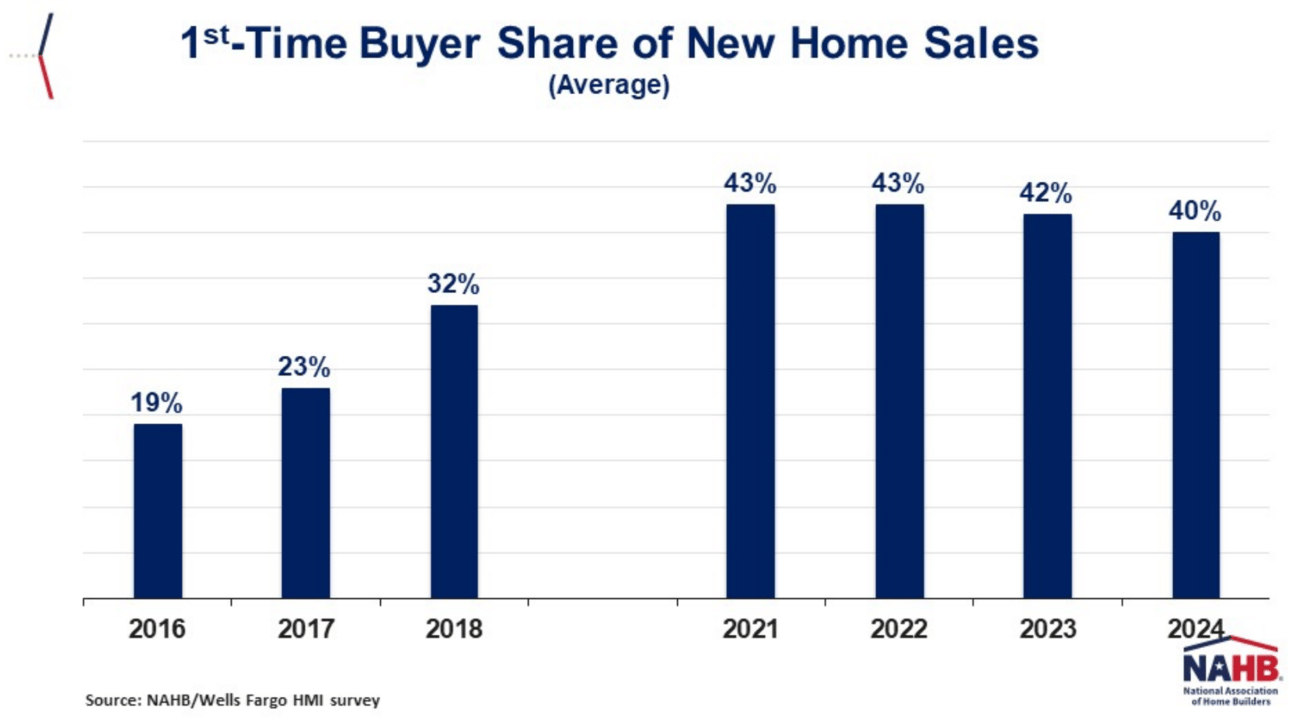

FIRST-TIMERS FADING: NAHB Says Sales to 1st-Time Buyers are Slipping

On average, 40% of builders’ single-family home sales so far in 2024 have been made to first-time home buyers, according to the most recent NAHB/Wells Fargo Housing Market Index survey (HMI). That share has doubled since 2016, when only 19% of builders’ sales went to first-time buyers.

INVESTOR ACTIVITY NORMALIZING? CoreLogic

Investor activity in the housing market remained high in Q124, but the second quarter of the year saw investor activity take its first step back in two years.

In January, the share of single-family purchases made by investors was 29.8%, but dropped to 23.4% by June.

June’s investor percentage was the lowest in two years and was equivalent to May’s numbers.

January’s number was at an all-time high based on CoreLogic’s data that goes back to 2010.

The investor share still sits well above where it was prior to the COVID-19 pandemic, when it consistently oscillated between 15% and 20%.

FORECLOSURES FELL: FHFA Q224 Foreclosure Prevention & Refi Report

Foreclosure starts fell 7% to 17,339 in Q2

Third-party and foreclosure sales dropped 7.4% to 2,944.

Refi numbers increased 28% QoQ: 69,877 in Q1, 89,571 in Q2.

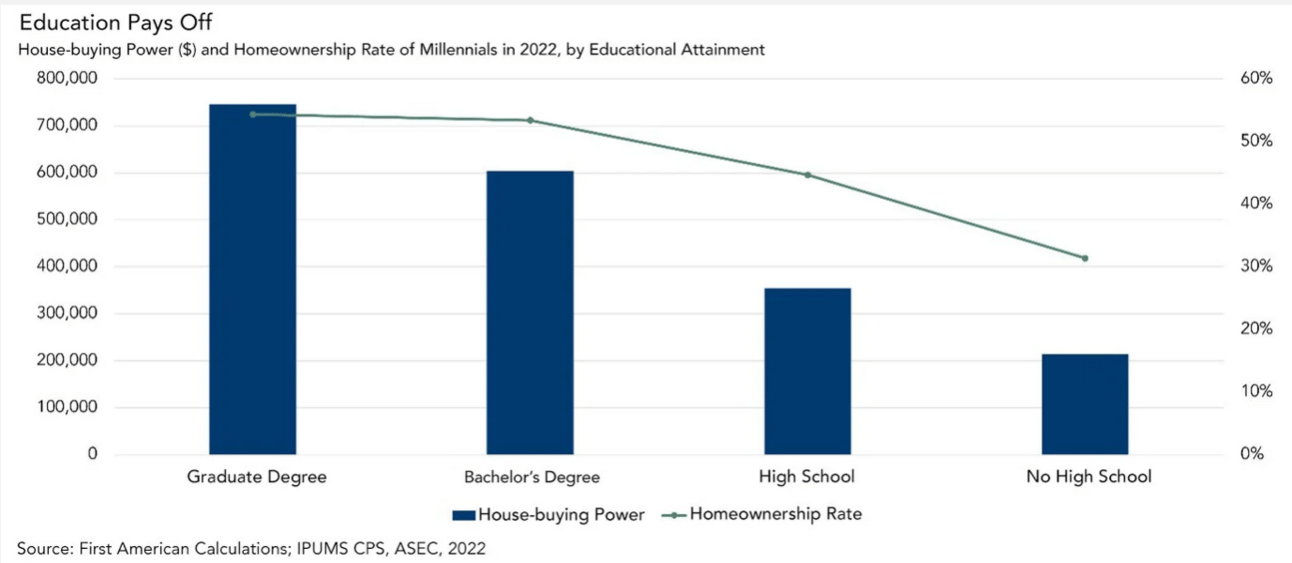

DEBT NOT DEALBREAKER: First American posits that student loan debt is NOT barrier to homeownership

Longer repayment terms and lower interest rates have increased students’ “education-buying power” and lowered payment-to-income ratios reducing the impact of rising student loan balances over time.

Millennials’ pursuit of higher education significantly boosts earning potential and house-buying power, making student loans more likely to delay rather than prevent homeownership.

Among millennials, those with a bachelor’s degree had approximately $250,000 more in house-buying power and a 12.8% higher homeownership rate in 2022 than those with only a high school diploma, highlighting the strong link between educational attainment and homeownership.