- InGeniusly Speaking

- Posts

- What to Watch

What to Watch

By Jeff Walton & Kelly Guest

Table of Contents

CHATTER

Would You Fly in a Plane That’s Under Construction?

NAR announced its 2026-28 Strategic Plan, and CEO Nykia Wright had some choice remarks: "NAR is rebuilding trust by executing the largest transformation in real estate history, and this Strategic Plan will be our roadmap.” HousingWirereports Wright also said, “We’re building the plane as we fly it.”

The Backstory of a Fed Resignation?

Furtive Fed: Former Fed Governor Adriana Kugler is under investigation for violating various central bank ethics rules, including, but not limited to stock trades during blackout periods and stock purchases by family members.

Figure Technology Solutions Releases Q325 Earnings: Consumer Loan Marketplace volume was $2.5B in the quarter, a 70% increase from the prior year. This included Figure Connect volume of $1.1B, up from $767M in the second quarter. The Figure Connect platform was launched in June 2024.

50 Under Fire

“If ‘free money’ broke housing before, a 50-year mortgage will finish the job.” HW Opinion Piece

MOVING & SHAKING

NewDay USA adds to leadership team: Ken Harthausen was named president of NewDay Home's Builder Division and Neil Brooks as president of NewDay Home.

bevri.ai named Jonathan Haddad CEO to grow the agentic AI loan origination program.

Rice Park Capital Management acquired Rosegate Mortgage: NMN

MARKET/INDUSTRY

Data Deluge: The government is back open, get ready for an onslaught of info that was unavailable during the shutdown. Bill Bodnar has what to watch this week in his latest Master the Markets segment.

Mortgage Rates Broadly Flat: Freddie 11-13-25

147% is a Big Number – Are you Feeling It?

Mortgage Applications Increased 0.6% from One Week Earlier: MBA Weekly Survey for the week ending 11-7-25. Refi apps still showing big YoY increases at 147% last week.

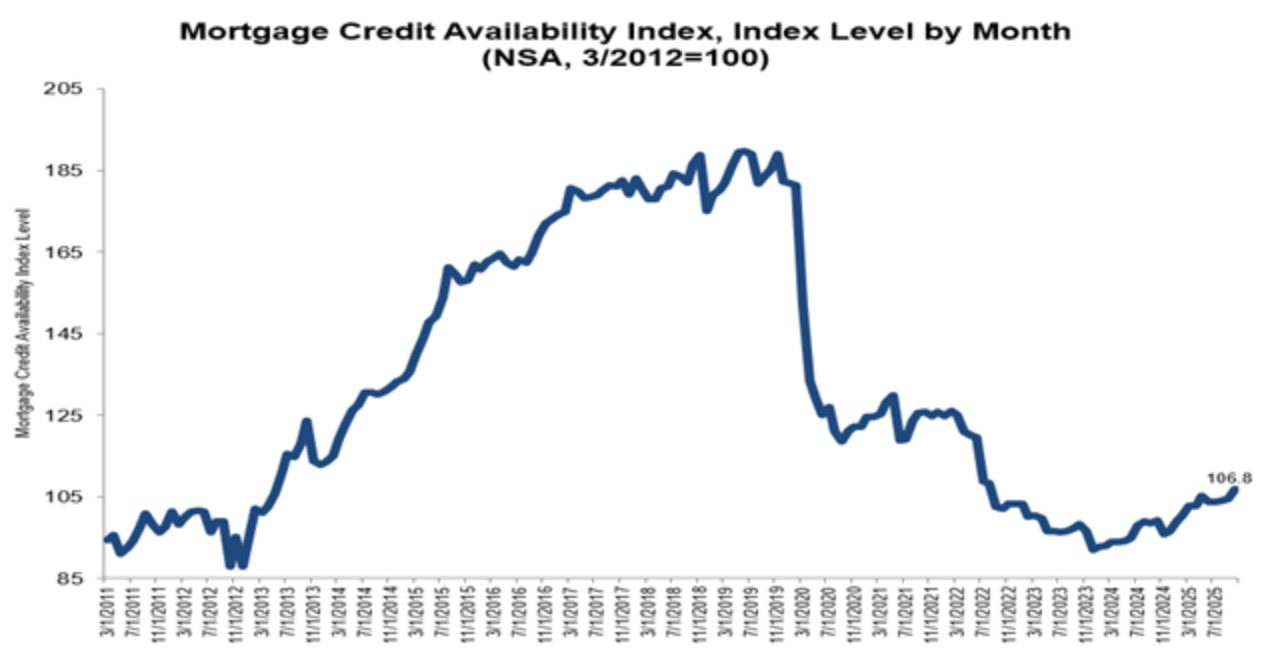

Mortgage Credit Availability – Shades of ’22 and ’13: MBA MCAI

The MCAI rose by 2.3% to 106.8 in October. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 4.1%, while the Government MCAI increased by 0.1%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 5%, and the Conforming MCAI rose by 2%.

“Credit availability in October rose to its highest level since 2022 as investors broadened their loan offerings over the month. ”Joel Kan, MBA’s Vice President and Deputy Chief Economist.

A Panorama of Predictions

Positive Prediction: NAR Chief Econ

Existing-home sales are projected to rise by around 14% in 2026, according to National Association of REALTORS® Chief Economist Lawrence Yun. Yun delivered his 2026 housing outlook today during the Residential Economic Issues and Trends Forum.

Yun said the expected rebound reflects easing mortgage rates, continued job gains, and improving market stability after several challenging years. Home prices are forecast to increase by 4% next year, supported by steady demand and persistent supply shortages.

"Next year is really the year that we will see a measurable increase in sales. Home prices nationwide are in no danger of declining." NAR Chief Economist Lawrence Yun

Six for 2026: Predictions from First American

“The housing market won’t return to normal in 2026, but it should bring further progress as life events pull more buyers and sellers into action.” – 1st Am Deputy Chief Econ Odeta Kushi

Prediction 1: Affordability will steadily improve, mostly via prices and paychecks

Prediction 2: Demographics and ‘life happens’ will lift sales activity

Prediction 3: Regional variations will persist

Prediction 4: Pockets of weakness, but no wave of distress

Prediction 5: Inventory will steadily rise as lock-in loosens

Prediction 6: New homes keep the edge—sell what is built, then set the pace

Fitch Shares Paltry 2026 Predictions: NMN

The U.S. residential housing economy growth will have slowed by 1.1% this year, from 2% in 2024, a result of cost pressures derived from higher tariffs on builder supplies like lumber, labor issues and weaker consumer and homebuilder sentiment about the sector, Fitch Ratings said.

Over the next two years, it expects restrained growth rates of 1.3% in 2026 and 1.9% in 2027.

More Normal Numbers? ICE 11-25 Mortgage Monitor

Interest Rate, Refi Update:

With mortgage rates at 6.17%, the number of highly qualified refinance candidates – those with 720+ credit scores, 20% equity, and potential rate savings of 75 bps or more – increased to 1.7M, the largest such volume in 3.5 years

Excluding credit scores and equity requirements, as of Oct. 28, there were 4.1M mortgage holders with rates that would meet that 75 bps savings threshold

If mortgage rates drop slightly to 6.125%, that number could surge to 5 million, due to a large concentration of borrowers with rates just under 7%

The MBA Refinance Application Index trended higher in the week ending Oct. 24 on increased refinance incentives but remained below the peaks of mid-September

Given the sensitivity to modest rate movements in their current range, borrower refinancing behavior will be worth watching closely in coming weeks for impacts on lending volumes and prepayments among recently originated loans

Equity Update:

Mortgage holder equity levels are stabilizing due to slower home price growth, but improved borrowing costs could benefit equity holders and lenders in the coming quarters

As of Q4, mortgage holders have $17.3T in home equity, including $11.2T in tappable equity ‒ accessible via cash-out refinances or home equity lines while maintaining 20% equity in the property

Tappable equity is down seasonally from an $11.7T peak this summer and flat year over year, marking the slowest growth in over two years. The average mortgage holder has $204K in available equity

Total first and second lien debt reached a record $14.7T in Q3, represent

While overall negative equity rates remain low, certain markets are showing signs of concern, particularly in the Gulf Coast of Florida and Austin, Texas

Borrowers with low down payment FHA/VA loans in these areas face even higher negative equity rates, exceeding 60% in some cases

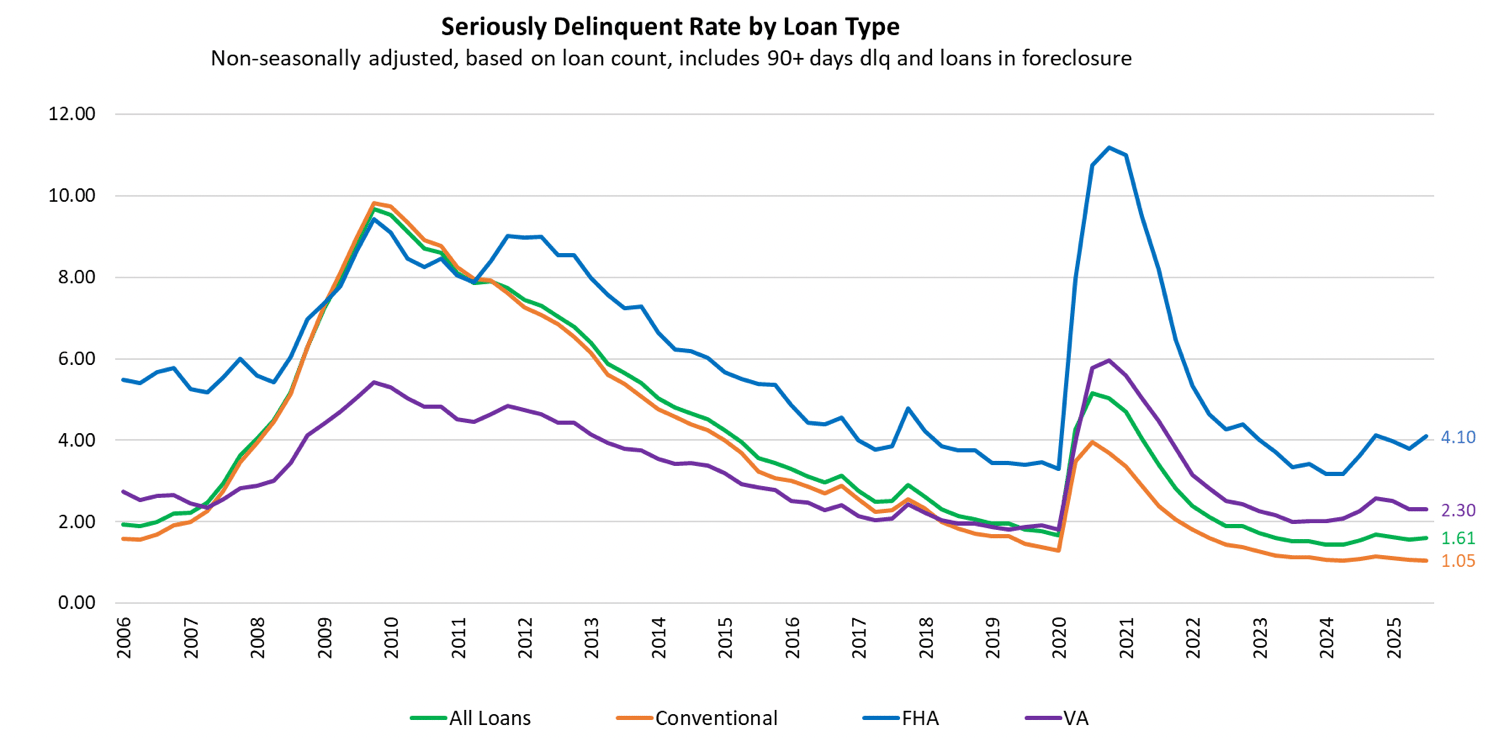

Delinquencies Developing: MBA Q325 Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.99 percent of all loans outstanding at the end of the third quarter of 2025, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

“Mortgage delinquencies increased in third quarter of 2025, led by worsening FHA loan performance. The stressors on FHA homeowners include a softer labor market, other personal debt obligations, and increases in taxes, homeowners’ insurance and other fees that exacerbate already stretched affordability. Additionally, home price declines in some parts of the country may lessen the ability to sell or refinance.” - Marina Walsh, CMB, MBA’s Vice President of Industry Analysis